Unleash Pullback and Hidden Divergence Trading at Quotex

Discover the potential of the pullback and hidden divergence trading strategies on Quotex. Optimize entry points, mitigate risk, and elevate your trading game today.

Various strategies and tools are available for enhancing the profitability of your online trading. Using a combination of chart patterns and technical indicators, it is possible to trade pullbacks with hidden divergence. A strategy like this can help you uncover intriguing trading opportunities using advanced digital trading platforms like Quotex.

WHAT IS PULLBACK TRADING?

Trading pullbacks is a strategy that traders use to capitalize on market retracements. A pullback refers to a temporary price reversal following a significant move in a financial instrument’s price, either upward or downward. If the trend reverses, pullbacks are excellent opportunities to obtain a more favorable price than previously available, potentially boosting profits.

For example, consider a situation where you are examining the chart of a particular asset, like gold, on the Quotex platform. A pullback occurs when the price falls slightly after an uptrend — this is when the cost is in an uptrend. This slight dip in gold’s price would attract pullback traders who anticipate the uptrend to resume and gold’s price to continue to rise.

Managing timing is critical while trading pullbacks at Quotex. A pullback should not be confused with a trend reversal. Price patterns and market indicators must be analyzed and interpreted carefully when determining whether a price movement represents a pullback or a reversal.

What Is Hidden Divergence?

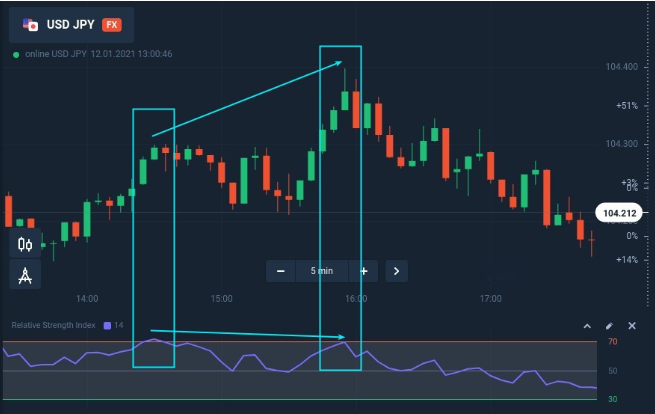

Hidden divergence, a type of divergence in technical analysis, indicates future movement in the current trend. Regular departure often signals the start of a trend reversal, but hidden divergence can signal the continuation of the current trend. In the case of hidden divergence, an asset’s value moves at odds with a momentum indicator, such as the Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI).

The RSI indicator may show higher lows on Quotex when the price reaches lower lows, but the price reaches lower lows on Quotex when the RSI indicator indicates a downward trend. There is a bullish hidden divergence in this chart, and it suggests that the upward trend may continue. Traders might consider this an ideal buying time, anticipating a price rise.

RSI divergence is bearish when an asset in an uptrend makes higher highs while the investment in an uptrend makes lower highs. It could indicate a solid upward trend that could continue, allowing selling.

Using hidden divergence and pullback trading together can be powerful tools in a trader’s arsenal. By understanding these concepts, traders can maximize profit and minimize losses while trading on Quotex.

UNDERSTANDING THE BASICS OF PULLBACK TRADING

According to pullback trading theory, prices move in waves, not linearly, and buying low and selling high is more profitable. Prices often retrace or pull back during a strong uptrend or downtrend before continuing in the right direction.

Quotex provides a candlestick chart that lets you see these price waves easily. Suppose you are monitoring Bitcoin’s price movement, trending upward. However, there are times when the price drops temporarily. The dips in price represent opportunities to buy during these pullbacks. By buying at these pullbacks and selling when the price rises, you can adhere to the original trend.

The Benefits of Pullback Trading

A versatile platform like Quotex makes pullback trading even more appealing, offering numerous advantages. In the first place, pullbacks often provide traders with more favorable entry points, allowing them to purchase assets at lower prices and sell them at higher prices during uptrends and downtrends.

Consider the case where you’re watching a steadily rising stock price on Quotex. There is a sudden pullback in the price. You can reap greater profits if you purchase the stock during this pullback instead of waiting for the price to resume its uptrend.

A second advantage of pullback trading is its enhanced risk-reward ratio. When you enter the market at a more favorable price point, you have a greater chance of gaining than losing.

Identifying Support and Resistance Levels

It is crucial to understand support and resistance levels when trading pullbacks. For the price to decline further, support levels must be strong enough to overcome selling pressure, thus halting further declines. When the pressure of sale exceeds buying interest, resistance levels prevent further price increases.

Using Quotex, you can draw horizontal lines at levels of support and resistance where the price has repeatedly stopped falling. It is possible to consider 1.1800 as a support level if the price rebounds back up after reaching it frequently.

You can use these levels to determine your pullback trading strategy if you recognize them. It is possible for a pullback to halt and reverse at a support or resistance level, resulting in an ideal entry or exit point.

When Is the Best Time to Enter a Trade?

Choosing the right time to enter a pullback trade is crucial. The pullback presents potential opportunities, but joining a trade too early or too late can hurt profitability. When the price resumes its original trend following a pullback, it is often an excellent time to enter a trade.

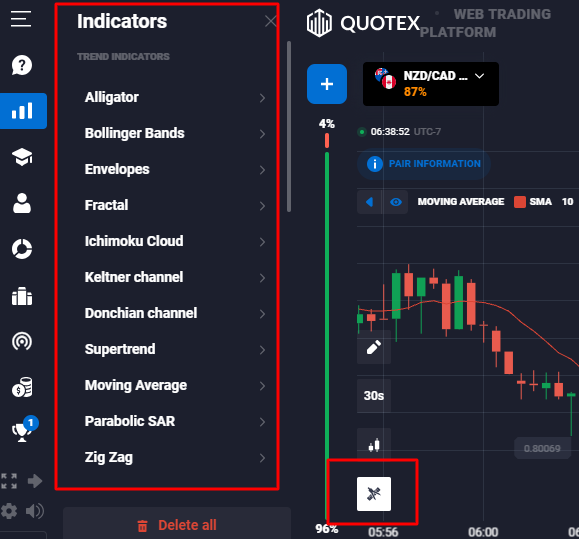

You can use a technical indicator such as Moving Averages, Bollinger Bands, or the Stochastic Oscillator on Quotex to help identify the end of a pullback. When an upward-trending asset dip bounces back above a moving average line, that could mean the pullback is over and it’s time to go long (buy).

Stop-loss orders are crucial in limiting potential losses and developing a solid risk management strategy since pullbacks are not guaranteed to resume the original trend.

USING TECHNICAL INDICATORS TO ANALYZE PRICE ACTION

To make sound trading decisions, traders use a variety of indicators — statistical calculations based on price and volume data. The combination of indicators and price action analysis offers a powerful way to navigate the financial markets. This integration between indicators and the Quotex platform allows traders to make better decisions and improve their trading strategies.

What Is Technical Analysis?

Technical analysts identify trading opportunities and evaluate investments by analyzing historical trading activity. Volume and price movement are examples of this. Unlike fundamental analysts, who focus on the value of a company, technical analysts use price movement charts and other analytical tools to evaluate an asset’s strength or weakness.

Using Momentum Indicators to Measure Divergences

Divergences may signal a trend reversal or continuation and help identify profitable trading opportunities, particularly with momentum indicators such as MACD and Relative Strength Index (RSI).

Imagine, for example, that you’re trading oil on Quotex. As the oil price climbs, the RSI makes lower highs while the price uptrends. A bearish divergence is occurring here, indicating that the upward trend may soon reverse into a downward trend. It might be wise to take a short position in such cases, anticipating a decline in the price of oil.

Using Oscillator Indicators for Spotting Oversold Conditions

Using oscillator indicators, like the Stochastic Oscillator and Relative Strength Index, allows traders to identify overbought and oversold market conditions. Often, oversold conditions indicate that an asset might experience a price increase or correction if it reflects an overvalued price. However, overbought conditions often suggest that an asset may experience a price increase if it is undervalued.

Suppose you are tracking a technology stock on Quotex. Stocks that dip below 20 on the Stochastic Oscillator may indicate oversold, implying that selling pressure will likely wane soon and a price increase is imminent. The oscillator may predict overbought conditions if it rises above 80, suggesting that a price drop will occur if the buying pressure soon decreases.

With such indicators, you can gain valuable insights into market conditions, enabling you to improve your trading strategy and predict price movements more accurately.

TRADING PULLBACKS AT QUOTEX WITH HIDDEN DIVERGENCE

To trade pullbacks with hidden divergence, Quotex offers several powerful tools that combine price movements with technical indicators to simplify the process. Use Quotex to trade pullbacks with hidden divergence effectively by following these steps.

Setting Up the Quotex Charts

To trade successfully, you need to set up your charts correctly. The Quotex interface makes setting up charts simple.

Choose the “Candlestick” chart type to visualize price movements and spot potential pullbacks for any asset you wish to chart (such as a currency pair, commodity, or stock).

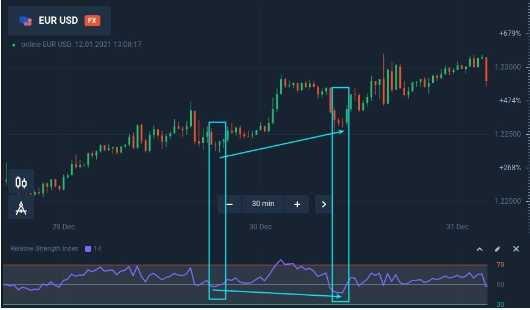

The next step is to choose a compatible time frame. Intraday traders might prefer time frames of 5 minutes, 15 minutes, or 30 minutes. At the same time, swing traders may prefer daily or weekly time frames.

After configuring your technical indicators, you can identify hidden divergences and pullbacks.

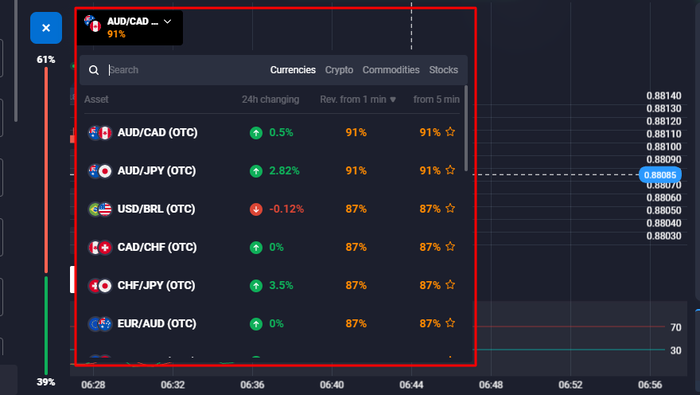

Choosing the Right Currency Pair and Period

Choosing the right currency pair and time frame depends on several factors, including your trading strategy, risk tolerance, and market volatility. You should pick an active pair with good liquidity and compatibility with your risk profile during trading hours.

Trading EUR/USD and GBP/USD during the European session is a good choice because of its high volatility and liquidity.

For example, if you’re a swing trader, you might prefer 4-hour or daily charts over 1-minute charts, while day traders might prefer 1-minute charts.

Applying Classic Divergence Patterns to Your 5-Minute Chart

Quotex allows traders to spot potential market reversals by using classic divergence patterns. For example, using MACD or RSI indicators will help spot these patterns.

In a scenario in which the price makes higher highs, and the MACD makes lower highs, as shown on a 5-minute chart of the EUR/USD, a bearish divergence is indicated, indicating a possible short position if the market reverses from an uptrend to a downtrend.

Using Bollinger Bands for Spotting Trend Reversals

Bollinger Bands are an excellent tool for identifying trend reversals when combined with pullback trading strategies. Both the middle and outer bands are standard deviations from the middle band.

You can use Bollinger Bands to chart if you track the GBP/JPY pair and see that the price consistently reaches the upper band before slipping back toward the middle band. Shorting the stock when there is a potential price reversal could be a great idea.

Stop-loss orders are essential to protecting your capital and maintaining a solid risk management strategy when trading involves risk. Practicing your techniques on a demo account is also a good idea before investing real money.

BOTTOM LINE

Trading pullbacks with hidden divergences offers a powerful and effective way to identify potential trading opportunities. When traders recognize price retracements within a trend and spot hidden divergences, they can find more profitable entry points, improve their risk-reward ratios, and increase their profits.

With a thorough understanding of technical analysis and a versatile platform like Quotex, traders can make informed and profitable trading decisions. To protect your trading capital, it is vital to practice good risk management, as with any trading strategy.