How to Catch Tops and Bottoms with the Harami Pattern on Quotex

The Harami Pattern on Quotex can help you catch market tops and bottoms more accurately. Combine it with indicators for even better results.

Do you want to improve your trading skills on Quotex with a powerful trading pattern? Are you wondering how to identify potential bottoms and tops in the market? Is it possible to recognize these reversals early on and take advantage of them?

The Harami Pattern might be the answer to your questions! Traders can use this pattern to spot potential reversals in the market, making it invaluable when trading on platforms like Quotex.

A candlestick pattern known as the Harami Pattern is used to detect potential reversals in the market. Trading can use this to catch tops and bottoms, which refer to buying and selling at the turning points in market trends. It is possible to use the Harami Pattern on Quotex, a platform that offers a wide range of assets for trading.

WHAT IS THE HARAMI PATTERN?

A Harami Pattern is a two-candle pattern that indicates a possible market reversal when the preceding candle is followed by one smaller and within the candle’s range. A “Harami” candlestick is a large candlestick followed by a smaller candlestick that appears encased inside the larger candlestick. The pattern is named after an old Japanese word that means “pregnant,” describing its appearance.

A Harami Pattern can be used to identify potential market turning points in Quotex, a trading platform offering binary options and other assets. In this way, traders on Quotex can make more informed decisions about when to take or leave trades.

Understanding the Basics of the Harami Pattern

A Harami pattern occurs when a small candlestick, known as the “inside candlestick,” is entirely contained within the range of the previous candlestick, known as the “outside candlestick”.

The outside candlestick is usually longer and entirely engulfs the inside candlestick. The Harami pattern is mainly used to identify a trend reversal from an upward or downward trend.

How to Recognize the Harami Pattern

- Look for a visible trend in the chart. The trend could be an uptrend or a downtrend.

- Look out for the outside candlestick, which is always a long bearish or bullish candlestick, depending on the trend.

- Identify the inside candlestick, which must always be a different color than the outside candlestick.

- Confirm that the inside candlestick is completely contained within the range of the outside candlestick.

- Wait for confirmation of the pattern from other technical indicators like volume, moving averages, and trend lines.

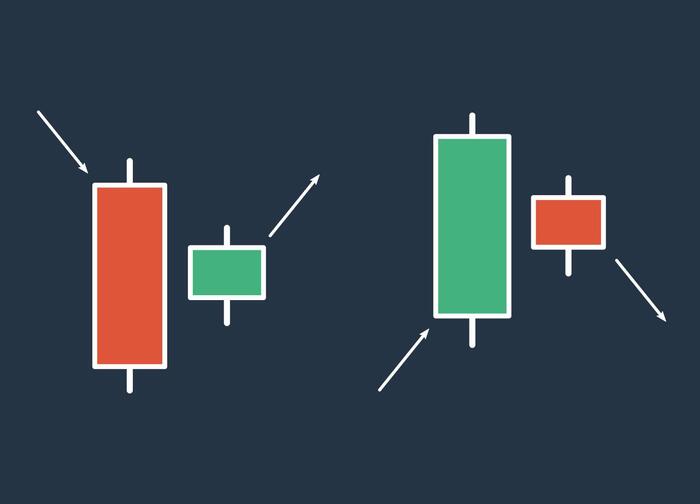

Types of Harami Patterns

- Bullish Harami: Signals the end of a bearish trend and a potential bullish reversal. It occurs when a shorter bullish candlestick follows a longer bearish candlestick and the former stays within the vertical range of the latter.

- Bearish Harami: Signals the end of an uptrend and a potential bearish reversal. It occurs when a shorter bearish candle follows a longer bullish candle and the former stays within the vertical range of the latter.

How to Catch Tops and Bottoms on Quotex

For traders to catch Quotex tops and bottoms using the Harami Pattern, here are the steps:

- Select the asset and time frame: First, select the asset you want to trade, followed by the appropriate time frame for the chart.

- Look for the Harami Pattern: An initial candle will be large, followed by a smaller candle placed within its range.

- Identify the context: Determine if the Harami Pattern appears at an uptrend’s peak or a downtrend’s bottom.

- Confirm with additional indicators: RSI or stochastics can serve as additional indicators when confirming a trend reversal.

- Set “stop loss” and “take profit” orders: If you want to manage risk, set a stop loss and take profit level before entering the trade.

- Enter the trade: When a bullish Harami is at the bottom of a downtrend, consider buying (long). Bearish Haramis at the top of an uptrend are good candidates for shorting (selling).

- Monitor the trade: Watch the trade closely and exit if it fails to move in your expected direction.

Example:

A bearish Harami pattern appears at the top of an uptrend on the 1-hour chart of EUR/USD traded on Quotex.

RSI shows the asset as overbought as a confirmation of the reversal signal.

In this scenario, you short the market (sell the stock), setting the take-profit level below the current price and the stop-loss above the recent high.

Upon reaching your take-profit level, you take profits as the market reverses as predicted.

When traders on Quotex understand the Harami Pattern and use it effectively, they can identify market tops and bottoms, which can be useful for trading. For the signals to be more accurate, managing risk and using additional technical indicators for confirmation is important.

IDENTIFYING A BEARISH HARAMI PATTERN

Choosing a bearish Harami Pattern can be the key to predicting potential market reversals on Quotex. We’ve put together a step-by-step guide to setting up your chart, picking out the bearish Harami Pattern, and setting stop losses.

Setting up the Chart

- Choose an asset: You can choose an asset in your Quotex account by logging in. There are currency pairs, commodities, and indices to choose from.

- Select a time frame: Consider your trading strategy when choosing a time frame. For day traders, you might choose charts with a 15-minute or 1-hour timeframe.

- Add a candlestick chart: Using candlestick charts is crucial for identifying Harami Patterns.

- Add supporting indicators: These technical indicators will help confirm your Harami Pattern signals, such as RSI, MACD, or Bollinger Bands.

Identifying the Bearish Pattern

- Look for an uptrend: Bearish Harami Patterns are significant when they appear after an upward trend. If you are looking for this pattern, the market must be uptrend.

- Spot the two candles: Observe that a large bullish candle follows a smaller bearish candle. To remain within the previous candle’s range, the smaller candle must be fully contained within it.

- Confirm with indicators: Check the reversal signal using technical indicators. The RSI, for example, may strengthen a bearish reversal signal if it is overbought.

Evaluating Risk and Setting Stops

- Evaluate market conditions: Pay attention to market volatility and current market conditions. Using this method, you can determine if your stop loss needs to be tight or loose.

- Set a “stop loss”: Stop your trade when the candle-high of the Harami Pattern is above the stop-loss mark. It protects you from further market rises.

- Determine a “take-profit” level: Determine where the market will reverse at the take-profit level. An entry point or a support level could serve as a guide.

- Enter the trade: Enter a short position if other indicators confirm the bearish Harami Pattern.

- Monitor the trade: Observe market movements and be prepared to exit.

Example:

What would you do if you are trading gold on Quotex after a significant uptrend and spot a bearish Harami Pattern on the 1-hour chart?

It confirms the bearish reversal signal that the RSI has reached overbought territory.

In the Harami Pattern, you decide to short the market, setting a stop-loss order just above the first candle’s high.

The take-profit level was set at a resistance level that used to be a support area.

As you monitor the trade, the market reverses in accordance with your expectations. It reaches your profit target and you exit the trade.

When identifying potential reversals, the bearish Harami Pattern can be an extremely useful tool, but only if used with other indicators and a proper risk management plan.

IDENTIFYING A BULLISH HARAMI PATTERN

If you’re interested in spotting potential upward reversals in the market through a bullish Harami Pattern, below is a step-by-step guide on setting up your chart, identifying the pattern, and setting your stops on Quotex.

Setting up the Chart

- Select an asset: Click the asset you wish to trade after logging in to your Quotex account. Among the options are currency pairs, commodities, and indices.

- Choose a time frame: Make sure your strategy aligns with your time frame. Swing traders might choose a chart that shows up every four hours or every day, for example.

- Apply a candlestick chart: To spot Harami Patterns, use the candlestick chart type.

- Add supporting indicators: You can validate Harami Pattern signals by adding technical indicators like RSI, stochastic, and moving averages.

Identifying the Bullish Pattern

- Identify a downtrend: It is most significant when the bullish Harami Pattern occurs after a downtrend. It is important to make sure the market is downtrending before trying to find this pattern.

- Spot the two candles: Look for a bullish candle followed by a bearish candle. There should be no difference in size between the smaller candle and the preceding candle.

- Confirm with indicators: Validate the reversal signal using the technical indicators you added earlier. Stochastics, for example, can support bullish reversal signals when in oversold territory.

Evaluating Risk and Setting Stops

- Assess market conditions: Consider the market conditions as well as the volatility of the asset. By doing so, you can determine the appropriate stop loss level.

- Set a stop loss: Put a stop loss order under the first candle’s low in the Harami Pattern. The safety net is an insurance policy if the market continues to decline.

- Determine your take-profit level: Determine the level at which you expect the market to reverse. The resistance level could be a percentage of your entry point or a certain level.

- Enter the trade: You must look at other indicators to enter a long position in response to a bullish Harami Pattern.

- Monitor the trade: Monitor market movements closely and exit when necessary.

Example:

After a notable downtrend, you recognize a bullish Harami Pattern on the 30-minute chart for USD/JPY traded on Quotex. It confirms the bullish reversal signal that Stochastic is in oversold territory.

In the Harami Pattern, you decide to buy a long position with a stop-loss below the first candle’s low. At a previous support level, you set a take-profit level.

Seeing that the market reversed, you exited with a profit after it reached your take-profit level. Regardless of the bullish Harami Pattern’s potential power to identify potential reversals, it should be used together with other indicators and risk management strategies.

TRADING WITH THE HARAMI PATTERN ON THE QUOTEX PLATFORM

Detailed instructions are included below to guide you through the Harami Pattern trading process on the Quotex platform, including how to open an account, analyze market trends, and place trades.

Signing Up for a Quotex Account

- Visit the Quotex website: Go to the official Quotex website.

- Register for an account: Click on the “Sign Up” or “Register” button at the webpage’s top right corner.

- Fill in your details: Enter your email address, create a strong password, and choose the currency for your account.

- Accept the terms: Read and accept the terms and conditions.

- Confirm your email: Verify your email address by clicking on the link sent to your email.

- Complete your profile: Provide the additional information that’s requested, such as your name and address.

- Deposit funds: Deposit funds into your account using your preferred payment method.

Analyzing Market Trends with Indicators

- Select an asset: Select an asset on Quotex that you would like to trade.

- Set chart type: For identifying Harami Patterns, choose a candlestick chart.

- Choose a time frame: Decide the time frame that best suits your trading style. Long-term traders might use daily charts, while short-term traders might use shorter time frames.

- Add indicators: To confirm the Harami Pattern, add indicators like the RSI, stochastics, and moving averages.

- Analyze the market: Look for Harami Patterns in the market trends. Make sure the pattern is valid by using the additional indicators.

Placing Trades with the Harami Pattern

- Set an entry point: After identifying a Harami Pattern and confirming it with indicators, set a price for entering the trade.

- Set a stop-loss level: Decide the point at which you will be forced to exit the trade. You minimize your losses by doing this.

- Set a take-profit level: Identify the level at which you will take your profit if the trade goes well.

- Choose trade size: Consider your risk management strategy when determining the trade size.

- Place the trade: You can start trading once you’ve set all the parameters.

- Monitor the trade: Whenever market conditions change, be prepared to close the trade manually.

Example:

You see a bullish Harami Pattern on a 1-hour chart after a downtrend when you’re trading EUR/USD on Quotex. Indicators such as stochastics confirm the oversold condition.

With a take-profit of 1.1050 and a stop loss of 1.0980, you decide to take a long position at the current market price of 1.1000. Depending on your risk management strategy, you set your trade size accordingly.

Market prices reverse upward after you place your trade, resulting in a profit.

It is important to remember that, while the Harami Pattern is a useful tool, it is not foolproof, and you should use it with other tools and adhere to a strict risk management plan.

BOTTOM LINE

Traders can use the Harami Pattern to catch market tops and bottoms effectively using the Quotex platform. It can be a valuable tool for identifying potential market reversals. The Harami Pattern, however, cannot be relied upon by itself. Trading success requires combining it with other technical indicators, adhering to sound risk management principles, and utilizing sound risk management principles.