How to Trade Rectangular Price Boxes on Quotex: Strategies for Maximum Profit

Learn to trade rectangular price boxes on Quotex for maximum profit! Identify breakouts and use risk management strategies. Withdraw funds with ease.

Trading rectangular price boxes on Quotex is fairly simple. Let’s explore how you can use this strategy to increase your profit on Quotex.

WHAT IS QUOTEX?

Quotex is an internet-based brokerage company where you can trade diverse assets, such as currency pairs, stock indices, cryptocurrencies, and commodities. The company facilitates a risk-free way to practice trading strategies through demo accounts. Once you’re ready, you can easily open a live trading account with multiple deposit options, starting as low as 10 USD and without any deposit fees.

Quotex offers appealing bonuses of up to 35% as an added incentive. Their trading platforms are user-friendly, with readily available customer support for any required assistance.

Overview of Rectangular Price Boxes

The rectangle represents a well-known pattern in technical analysis. It features horizontal lines that indicate essential levels of support and resistance. You can trade this pattern by purchasing when the price reaches the support level and selling when it reaches resistance. Alternatively, you can wait for a breakout from the pattern and apply the measuring principle to guide your trading decisions.

UNDERSTANDING RECTANGULAR PRICE BOXES

Before learning how to trade these rectangular price boxes, you first need to understand them. Below is everything you need to know about rectangular price boxes to enter more profitable trades.

What Are the Benefits of Trading Rectangular Price Boxes?

Here are some benefits you can experience while trading rectangular price boxes.

- Planning your entry and exit points is easier when working with rectangle patterns. These patterns have clear and defined horizontal support and resistance levels, making it easier to identify them.

- The predictable price movements of rectangular patterns create opportunities to capitalize on potential breakouts and reversals, which display a period of consolidation and balance between buyers and sellers during the consolidation phase.

- You can decrease your overall risk exposure in a trade by placing stop-loss orders closer to your entry points. The ability to manage risk is due to the existing support and resistance levels.

- Estimating potential price targets using the measuring principle is helpful when a breakout happens from a rectangle pattern. It aids in managing risk-to-reward ratios and setting realistic profit targets.

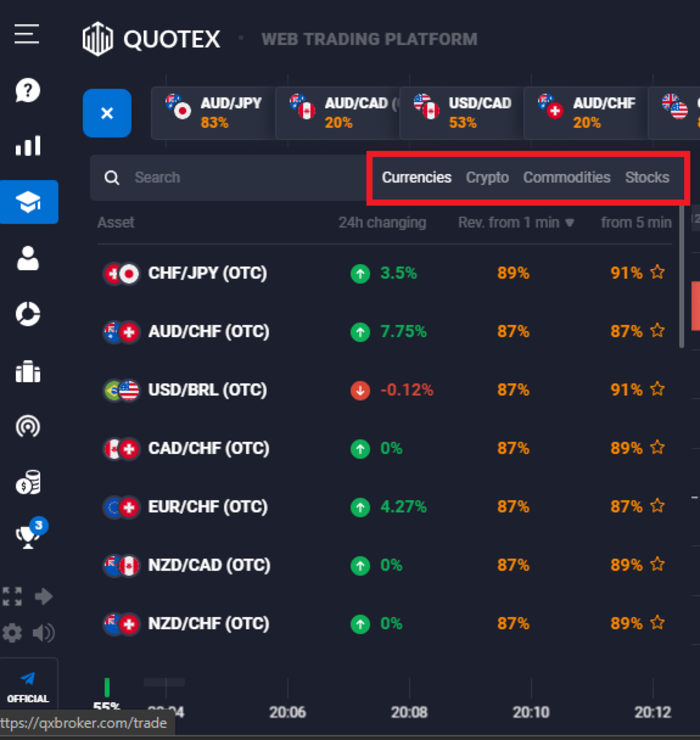

What Types of Assets Can You Trade with Rectangular Price Boxes

Well-defined horizontal support and resistance levels are the key characteristics of rectangle patterns. You can apply this versatile pattern to a variety of financial assets, including those mentioned below.

You can identify potential breakouts or breakdowns on individual stock charts, representing periods of consolidation called rectangle patterns.

Currency pairs in the forex market may exhibit rectangle patterns, which you can use to identify potential breakout opportunities.

You can also identify commodity trading opportunities through rectangle patterns in silver, oil, and gold commodities.

How to Read a Rectangular Price Box on Quotex

Think of a price chart like an X-ray, revealing the inner workings of supply and demand. The rectangle pattern, characterized by a balance of supply and demand for an extended period, depicts shares trading within a narrow range, encountering resistance at the top and finding support at the bottom of the rectangle shape. This pattern can manifest over time or form rapidly amidst fluctuating bounds.

In any scenario, the rectangle signifies indecision among traders, as both bulls and bears hold comparable power. The rectangle pattern can function as either a reversal or continuation formation. As a reversal pattern, it marks the end of an existing upward or downward trend.

As a continuation pattern, it denotes a temporary pause in the prevailing trend, with the anticipation that the prior trend will eventually resume. Regardless of its purpose, the rectangle showcases a tug-of-war between buyers and sellers. Ultimately, either accumulation or distribution will prevail, leading to a breakout or breakdown of the shares.

Analyzing Volatility and Risk with Rectangular Price Boxes on Quotex

The first step for you is to measure the height of the rectangle pattern, which is the vertical distance between the support and resistance levels. By doing this, you can estimate the potential price movement if the price breaks out.

If the price range is larger, it indicates a higher level of volatility and the possibility for bigger price swings. Conversely, if the range is smaller, it suggests lower volatility and more controlled price movements.

You can limit unexpected price reversals by placing stop-loss orders outside the support and resistance levels defining rectangular patterns. Stop-loss orders allow for the containment of potential losses and risk management.

SETTING UP YOUR TRADE

Now let’s look at how to set up a trade on Quotex using the rectangular price boxes.

Choosing the Right Exchange for Your Trade

Here are some things to consider before choosing an exchange for your trades.

Security and regulation: You should prioritize secure exchanges. This includes encryption protocols and two-factor authentication (2FA).

Range of trading instruments: Exchanges offer different financial instruments. Choose an exchange that offers the asset you wish to trade.

Establishing Risk Management Parameters for Your Trade

Risk management is important when implementing trading strategies, and this strategy is no exception. The rectangular price box has defined support and resistance levels. It’s recommended to place your stop losses on these levels when trading breakouts. Stop losses can minimize your losses effectively, enabling you to manage risk.

Determining Entry and Exit Points for Your Trade

Entry and exit points depend on how you trade the rectangular price boxes on Quotex. If you trade breakouts, then your entry should be on the resistance or support level that the price breaks. You can base your exit point on a risk-reward ratio or another major resistance level.

If the trading price bounces within the rectangle, your entry point should be on the support, whereas your exit should be on the resistance level.

EXECUTING YOUR TRADE

Let us see how you can successfully execute trades on a rectangular price box.

Deciding When to Enter and Exit a Position in the Market

If you are trading the breakout, you can take the aggressive or the conserved approach. In the aggressive approach, you enter the trade immediately when the price breaks the resistance level.

In the conserved approach, you enter the trade only after the price breaks and then confirms.

Exiting a trade depends on your risk-reward ratio. You can also use major resistance levels on the price charts.

Utilizing Indicators for Enhanced Analysis of Trades

When trading the rectangular price box, you can use indicators to make confirmation. For instance, you can use the RSI. When employing the range-bound strategy, confirm that the price is overbought at the resistance level on the RSI. This increases the chances of the price bouncing off the resistance.

TRADING STRATEGIES FOR MAXIMUM PROFIT WITH RECTANGULAR PRICE BOXES ON QUOTEX

Rectangular price boxes offer a variety of profitable strategies. You can trade price breakouts from resistance levels within these rectangles. You can also employ the range-bound strategy that involves buying at support levels and selling at resistance levels.

BOTTOM LINE

Rectangular price boxes are easy to use, and you can employ several strategies to profit from these rectangles on Quotex.