Quotex in Singapore: How to Deposit Money with Bank Cards and Other Methods

Quotex is a cutting-edge digital brokerage platform that empowers individuals in Singapore to trade various assets. With user-friendly mobile and web-based platforms, Quotex streamlines the process of depositing funds into trade accounts, offering a range of convenient deposit methods explained in detail below.

BENEFITS OF USING QUOTEX IN SINGAPORE FOR TRADING

Below are some of the numerous benefits of trading on Quotex in Singapore:

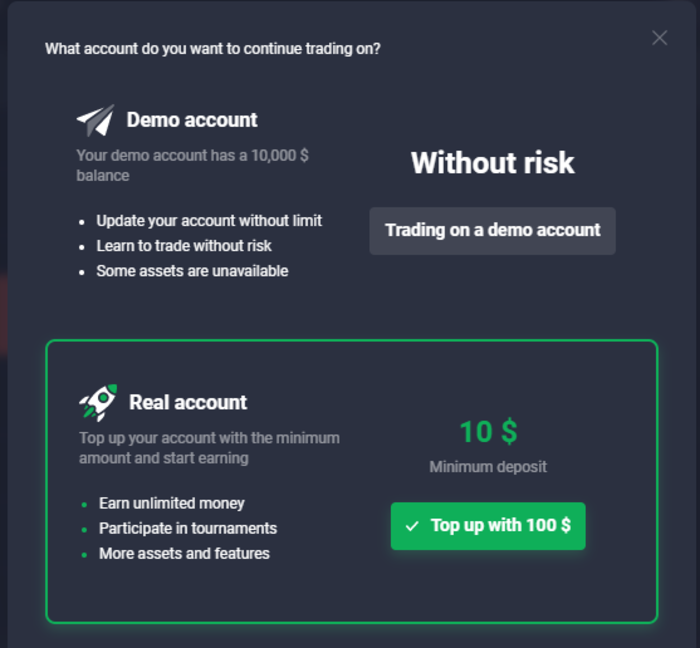

- You have the convenience and affordability of opening a real account with a minimum deposit of only 13.43 Singapore Dollars on Quotex. This grants you access to a platform that offers both real and demo accounts.

- The demo account is a risk-free environment to practice strategies, learn trading indicators, and gain confidence under realistic market conditions.

- Quotex provides a range of deposit methods, allowing you to select the most suitable option according to your preferences. Depositing and withdrawing funds with Quotex is free from additional broker fees, although transaction fees from facilitating institutions may apply.

- Quotex maintains a multilingual customer support center available 24/7 to ensure comprehensive support. This guarantees uninterrupted trading experiences and swift resolution of any technical issues that may arise.

- With Quotex, you can access an extensive range of assets, including cryptocurrencies, commodities like gold and silver, bonds, and 26 different currency pairs. This diverse selection enables portfolio diversification and exploration of various markets.

- Using cutting-edge technology, Quotex has designed user-friendly interfaces across all platforms, providing visually appealing graphics and sleek designs that enhance the trading experience.

DEPOSIT METHODS ACCEPTED BY QUOTEX IN SINGAPORE

Quotex allows you to deposit into your account through various payment methods. Let’s look at some of these more in detail.

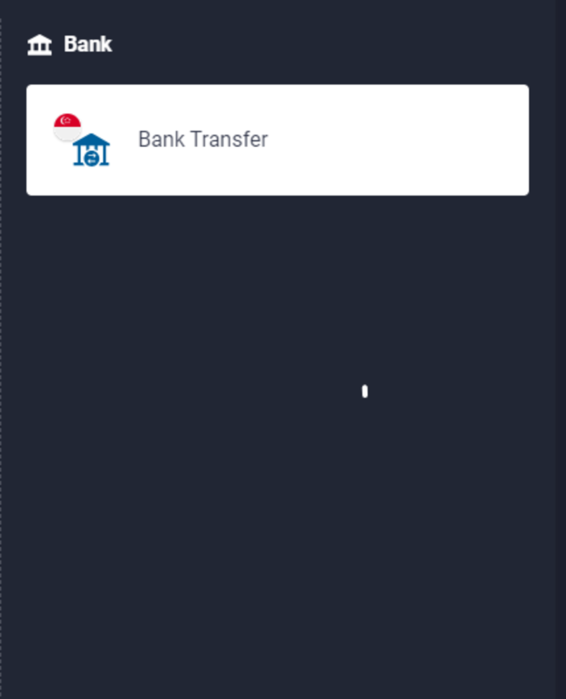

Bank Transfer / Wire Transfer

Bank transfer is a deposit option that allows you to transfer money directly from your bank account to Quotex’s designated bank account.

It involves initiating an online transaction through your bank and providing the necessary details, such as the recipient’s account number and the transfer amount. Your bank then facilitates funds transfer to the website’s bank account, typically within a few business days.

Advantages

- Bank transfers are generally considered a secure method of transferring funds. Banks have robust security measures to protect your transactions and personal information. This can provide you with peace of mind when depositing funds on Quotex.

- Bank transfers are relatively straightforward to initiate, especially with online banking facilities. You can conveniently transfer funds from your bank accounts to Quotex without the need for additional payment accounts or intermediaries.

- Bank transfers often allow for higher deposit limits compared to other deposit options. This can benefit users who intend to deposit larger funds into their Quotex accounts.

- While the processing time for bank transfers can vary depending on the banks involved, many banks process transfers within a reasonable timeframe. Sometimes, same-day or next-day transfers are possible, enabling users to quickly trade their deposited funds on Quotex.

- Bank transfers link your bank accounts and Quotex, allowing for better integration with personal finances. You can easily track transactions and manage deposit and withdrawal activities through your existing banking systems.

Disadvantages

- Bank transfers typically take longer to process compared to other payment methods. Some banks may take several business days to credit funds to your account. This delay can be inconvenient if you’re looking for immediate access to the services or products offered by the website.

- Banks often charge fees for performing wire transfers. These fees usually vary depending on the bank and the transfer amount. It’s important to consider these fees, as they can add to the overall cost of the transaction.

- Bank transfers are not anonymous, as they involve providing personal and banking information. If privacy concerns you, using a bank transfer as a deposit option may not be ideal.

- Mistakes can happen during the bank transfer process, such as incorrect account numbers or other errors in the transaction details. Resolving these issues can be time-consuming and may require coordination between the website, the bank, and yourself.

Credit Card / Debit Card

A credit/debit card is commonly a plastic card issued by a bank to its customers, providing access to various services associated with their bank account.

In terms of its physical features, a credit/debit card typically displays the client’s name, the issuer’s name, and a unique card number. It also incorporates a magnetic strip on the back, which enables the card to be read by different machines and facilitates access to relevant information.

Depending on the issuing bank and the client’s preferences, the card may function as an ATM card, allowing transactions at automated teller machines, or as a debit card linked to the client’s bank account, enabling you to deposit on Quotex.

Advantages

- Credit or debit cards offer convenience and simplicity. Many individuals already have these cards, and inputting card details during checkout or depositing funds typically proves to be fast and effortless.

- Deposits made with these cards are processed instantly, allowing immediate access to the funds. This feature offers great convenience in time-sensitive situations or when you desire prompt trading on Quotex.

- Credit cards and debit cards often provide built-in fraud protection measures offered by the card issuer. These measures include safeguards against unauthorized transactions and the option to dispute charges in case of deposit issues.

- Most credit cards offer rewards programs, such as cashback, airline miles, or points, which can provide additional value when using them for deposits. Some cards also offer purchase protections, extended warranties, or travel insurance benefits that can enhance your overall experience.

- Using credit cards responsibly can contribute to building a positive credit history. This can benefit future borrowings or financial endeavors, such as obtaining loans or mortgages.

Disadvantages

- Sometimes people may encounter the unfortunate situation where their credit or debit card information gets stolen or used illegally. This can result in unauthorized charges appearing on their account. Although many banks and card issuers have systems in place to detect and handle these issues, resolving fraudulent transactions and recovering lost funds can still be a bothersome process.

- When individuals utilize credit or debit cards to make online transactions, they are often required to share personal and financial information. This necessity can inevitably lead to concerns surrounding privacy. As a precautionary measure, it is crucial to ensure that Quotex’s privacy policy and security protocols are thoroughly vetted to safeguard your sensitive data.

- When conducting transactions in a different currency or using your card on Quotex, it’s important to be aware of potential international transaction fees imposed by your bank. Such fees can cover currency conversion and may impact the overall cost of your deposit. The exact amount of these fees can vary depending on various factors.

- Some credit or debit cards may have limitations on online transactions, including depositing funds on Quotex. It’s important to check with your card issuer if any restrictions or limitations could affect your ability to use the card as a deposit option.

E-Wallets (PayPal, Skrill, Neteller, etc.)

The e-wallet deposit option involves the transfer of funds electronically, usually through secure payment gateways or online wallets.

Advantages

- E-payments offer the advantage of quick transactions. This payment method allows you to deposit funds into your account almost instantly, which does away with the delays associated with traditional payment methods like checks or wire transfers. This speed greatly enhances the overall user experience. E-payments go beyond geographical boundaries, making them accessible to you wherever you are. Quotex can accept e-payments from you no matter where you are.

- E-payments also prioritize security by implementing robust measures to protect users’ financial information. E-payments utilize encryption technologies and security protocols to safeguard transactions. This minimizes the risk of fraud or unauthorized access.

- Additionally, e-payment providers often offer features like two-factor authentication to enhance security further.

- One more advantage of e-payments is that they provide digital records of transactions. This ensures transparency and easy access to payment history. With the ability to track deposited transactions and obtain detailed statements, managing and reconciling finances becomes simpler. This contributes to a positive customer experience by providing a seamless and user-friendly deposit process.

- The convenience and speed of e-payments increase customer satisfaction, promoting repeat business and customer loyalty.

Disadvantages

It is important to acknowledge some disadvantages of e-payment systems as well.

- Resolving payment disputes or fraudulent transactions can be challenging because it often involves multiple parties such as Quotex, the payment gateway, and financial institutions. Consequently, this can make the resolution process more complex and time-consuming.

- Moreover, completing e-payment transactions requires a stable internet connection in areas with unreliable or limited internet access.

- Making e-payments can be difficult or even impossible at times. As a result, this restrains the convenience and accessibility of this particular deposit option.

Cryptocurrency (Bitcoin, Ethereum, etc.)

Using cryptocurrency refers to the ability to deposit funds using digital currencies such as Bitcoin, Ethereum, Litecoin, or other cryptocurrencies. It involves transferring a specific amount of cryptocurrency from the user’s digital wallet to Quotex’s designated cryptocurrency address.

Advantages

- Cryptocurrencies provide some privacy by allowing you to execute transactions without disclosing personal information. Cryptocurrencies record transactions on the blockchain, which makes the parties’ identities sometimes pseudonymous, offering some privacy.

- Cryptocurrencies are borderless, allowing for cross-border transactions without using traditional banking systems. This makes them especially useful for international transactions because they eliminate the need for currency conversions and reduce transfer delays or fees associated with traditional banking procedures.

- Cryptocurrency transactions are often executed rapidly, especially compared to traditional banking systems, which may require delays due to intermediaries. Furthermore, Bitcoin transaction fees are frequently lower than traditional payment methods, making them cost-effective for small and big purchases.

Disadvantages

- Cryptocurrencies are very volatile, meaning their value can quickly change dramatically. This volatility increases the uncertainty and risk level when using cryptocurrencies for deposits because the deposited cash’s value can fluctuate rapidly.

- Transactions with cryptocurrency necessitate a certain level of technical knowledge and awareness. You must have a digital wallet, understand how to transfer and receive cryptocurrencies, and be familiar with each coin’s procedures and needs. This complexity can be difficult for those who are unfamiliar with Bitcoin operations.

- Transaction fees for cryptocurrency transfers vary depending on the coin, transaction amount, and network congestion. These costs can quickly pile up, especially if you make frequent or substantial deposits, lowering the overall value of your account.

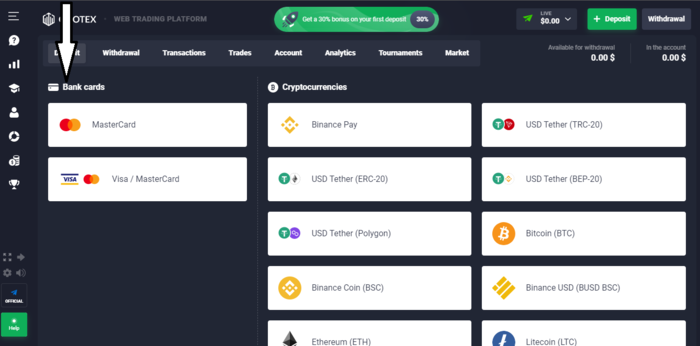

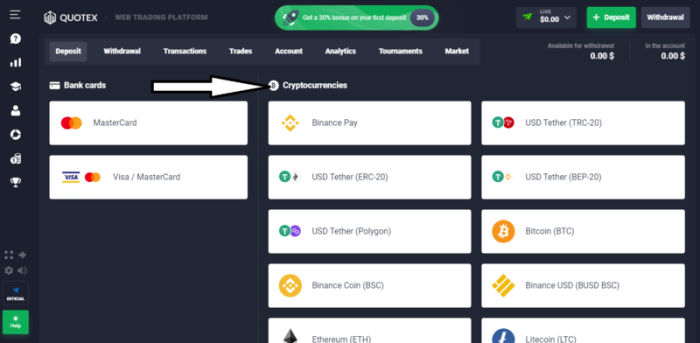

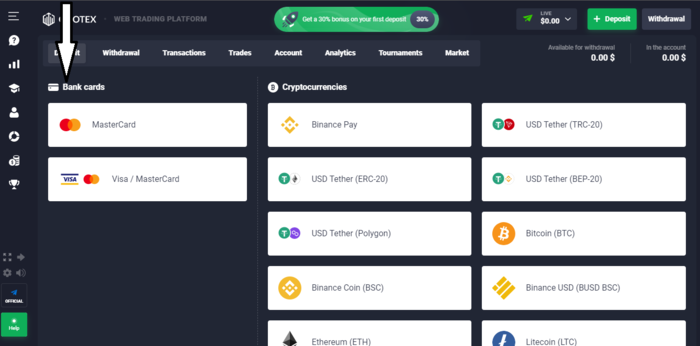

STEP-BY-STEP GUIDE TO DEPOSITING MONEY WITH BANK CARDS ON QUOTEX

Depositing on Quotex via bank cards is simple if you follow the steps below.

Step 1: Access Your Account and Choose the Deposit Option

Register for an account or sign in if you already have one. Click on the “Deposit” button in the top right corner of the trade execution window. You can then select the bank card deposit option.

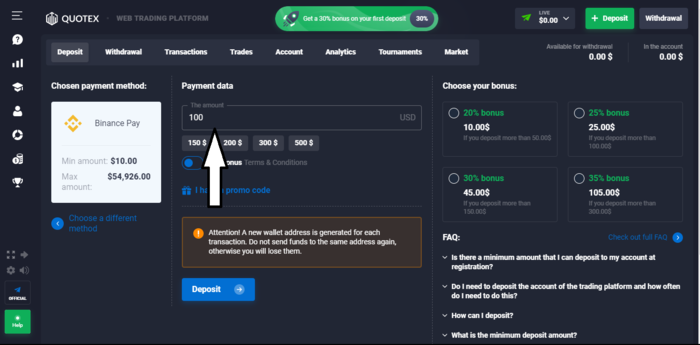

Step 2: Enter the Amount to Be Deposited

Enter the amount you wish to deposit in the allocated section.

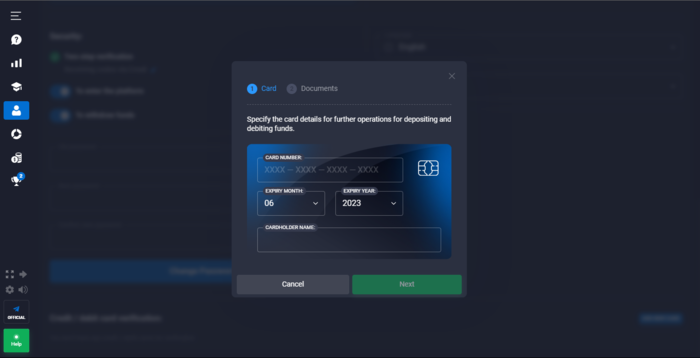

Step 3: Enter Your Card Details

Input the card details to initiate the transaction.

Step 4: Final Confirmation to Complete the Payment Process

Confirm your details, then click “Confirm” to complete the transaction.

IMPORTANT CONSIDERATIONS WHEN USING BANK CARDS FOR DEPOSITING MONEY ON QUOTEX IN SINGAPORE

Below are some things you should consider before choosing the bank card deposit option.

Maximum and Minimum Deposit Limits

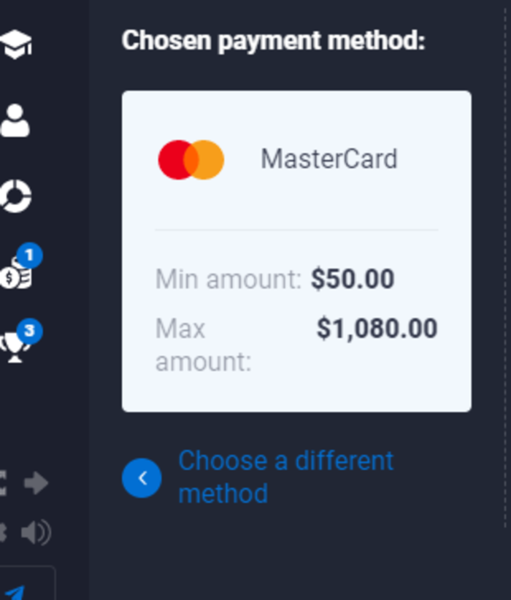

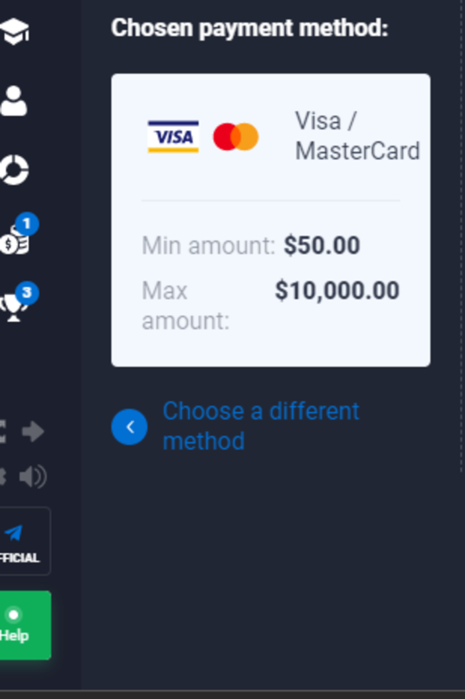

The bank cards have a minimum deposit of 67.08 Singapore Dollars. There is a maximum deposit limit of 1,448.91 Singapore Dollars for the Mastercard and 13,415.85 Singapore Dollars for the Visa Mastercard.

Fees and Processing Timeframes

Quotex does not charge you for depositing using bank cards, though the issuing bank may charge you transaction costs. The processing timeframes for bank card transactions can vary depending on factors, including the specific bank, the type of transaction, and any intermediary processes involved.

BOTTOM LINE

Quotex is an online brokerage firm that offers traders in Singapore the ability to deposit through various payment methods. These payment methods have pros and cons, which you should understand before making a choice.