Optimizing Trades on Quotex: Harness the Power of the McGinley Dynamic

Elevate your Quotex trading experience with the McGinley Dynamic. Discover trends, sidestep false signals, and build powerful strategies for trading success!

Traders who trade on Quotex will agree that making the most out of their trades involves more than just understanding the market; they need to use the best tools they have available. One such tool is the McGinley Dynamic, which experienced traders frequently take advantage of. Technical indicators such as this, which surpass traditional moving averages, are indeed game-changers. Let’s take a closer look at this fantastic tool.

WHAT IS THE MCGINLEY DYNAMIC?

The McGinley Dynamic addresses the lagging problem common in traditional moving averages by incorporating John R. McGinley’s expertise in market technical analysis. This is one of the most responsive trend-following indicators in the trading world due to its unique formula that auto-adjusts to market speed.

By staying close to the market price, the McGinley Dynamic delivers a smoother, more accurate line, helping to filter out market noise. A minimal price separation and lag results in a more accurate reflection of the market, enabling you to make more informed trading decisions.

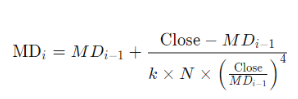

Here is the formula for calculating McGinley Dynamic indicators:

Where:

MD(i-1) = MD value of the preceding period

Price = the security’s current price

N = number of periods

Why Use the McGinley Dynamic on Quotex

As online trading evolves rapidly, your platforms must integrate well with dynamic indicators like the McGinley Dynamic. Quotex can help you with that. McGinley Dynamic’s application is simple and intuitive, even for beginners. The interface is clean and user-friendly.

On Quotex, one reason the McGinley Dynamic is so effective is because of its responsiveness. You need accurate, real-time market data when the market is in a hurry, and the McGinley Dynamic keeps you on top of things. This dynamic indicator keeps you in sync with the market regardless of whether you are tracking a solid uptrend or anticipating one.

GETTING STARTED WITH THE MCGINLEY DYNAMIC

A financial market can be a complicated place to navigate. It is significantly simplified when a tool like the McGinley Dynamic runs on Quotex, which works well and is reliable. It’s more than just an indicator — it’s an indispensable tool.

Quotex seamlessly integrates with the McGinley Dynamic platform through a highly intuitive and user-friendly interface. With the help of easy-to-understand and easy-to-follow charts, real-time market trends can be observed and tracked.

Its seamless interface and quick trade execution make Quotex stand out from other trading platforms. Further, it allows you to exchange trading ideas and insights with a dynamic and interactive community of traders, which can be a significant advantage for both beginners and experts.

Setting Up Your Charting Software

Setting up your charting software to work with the McGinley Dynamic on Quotex is essential to use this powerful tool. Choosing the McGinley Dynamic indicator is as easy as going to the indicators section.

Go to the TradingView indicator and select the McGinley Dynamic. A list of options is provided here, including the McGinley Dynamic. Following the asset price, a line will appear on your chart after you select it. You can quickly see how the market is trending with the McGinley Dynamic shown here.

Moreover, the McGinley Dynamic can be customized to meet your trading needs by adjusting its period setting. A shorter period setting, like 10 or 15, might be better if you prefer short-term trading. For long-term traders, however, a period setting of 50 or 100 might be more appropriate. With its adaptability, the McGinley Dynamic is suitable for various trading styles.

Implementing the Indicator on Quotex

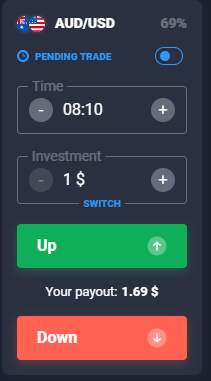

Quotex is an easy platform for implementing McGinley Dynamic. Choosing an asset to trade is the next step after setting up your chart. A currency pair, commodity, or stock is an option. Decide on a time frame that works for you.

Once you’ve done that, click on the McGinley Dynamic indicator. You can see the market trends in real time as the indicator overlays your price chart. Using the McGinley Dynamic, you can adjust your trading strategies based on market movements.

By aiding you in making more informed trades on Quotex, the McGinley Dynamic enhances your trading experience. A real-time data stream can help you maximize your returns by providing precise, reliable, and accurate information.

The McGinley Dynamic is also advantageous in a variety of market conditions. It can be instrumental in identifying the right opportunities and maximizing profits, regardless of whether your market is highly volatile or calm and rangebound.

INTERPRETING SIGNALS GENERATED BY THE MCGINLEY DYNAMIC

At first glance, McGinley Dynamic signals can seem daunting, but once you learn how to interpret them, it becomes straightforward. Its simplicity and effectiveness in identifying market trends make the McGinley Dynamic an ideal tool for Quotex.

When using the McGinley Dynamic on Quotex, you should know that it does more than cross the price and dynamic lines. Furthermore, it concerns the relationship between the active line and the price action. It indicates a strong trend when the price and the Dynamic move in the same direction. An inverse trend suggests a weakening movement, and a reversal may be imminent if the two move against each other.

In general, an upward movement of the Dynamic line indicates an asset price increase. Active lines that fall often indicate a downtrend, which implies a decreasing asset price. An upward trend is absent if the line flattens, meaning a sideways market.

False Signals to Avoid Trading On

Fortunately, the McGinley Dynamic does not usually generate false signals, but it is still essential to recognize these and avoid them. Identify signs that deviate from the overall trend or are followed by sudden price volatility. In the case of rapid price changes, the Dynamic line could temporarily differ from the price, but if it quickly returns, the signal may be false.

Identifying Trend Reversal Patterns with the McGinley Dynamic

In addition to identifying trend reversals, one of the McGinley Dynamic’s greatest strengths is its ability to predict them. Dynamic lines crossing from below are possible indicators of upward trends. A downward trend may be imminent when it travels from above. If you pay close attention to these crossings and the following price action, you can detect potential trend changes.

Reading and Understanding Price Action on a Chart with the McGinley Dynamic

Understanding and interpreting price action is essential for mastering the McGinley Dynamic. A strong trend occurs when the price and the Dynamic move in the same direction. An opposing movement could signal that the trend is weakening, and reversal could be imminent.

BUILDING TRADING STRATEGIES AROUND THE MCGINLEY DYNAMIC

The goal of every trader is to maximize their trading performance and returns. That’s when building trading strategies around the McGinley Dynamic becomes relevant. It is possible to provide a practical framework for executing trades by implementing such procedures on a platform like Quotex.

Developing Rules and Conditions for Trades

Trade rules and conditions are imperative to successful trading because they define how trades are entered and exited. Developing these rules is made easy with the McGinley Dynamic.

It is usually a good time to buy an asset when the McGinley Dynamic line crosses the price from below, signaling an upward trend. The Dynamic line may indicate a sell signal when it crosses the price from above and descends, indicating a downward trend.

However, it is essential to remember that while these signals can be powerful, we must use them with other indicators or strategies to avoid false signals and increase the accuracy of trades.

Utilizing Risk-Adjusted Returns

An essential component of your trading strategy should be risk-adjusted returns. Take-profit orders can help you secure gains by limiting losses, while stop-loss orders protect against potential losses. The McGinley Dynamic can be a powerful tool when determining optimal levels for these orders.

Quotex’s user-friendly platform makes it easy to integrate the McGinley Dynamic into your trading strategy. Its dynamic nature, combined with its intuitive interface, helps traders streamline trading decisions, manage risks more efficiently, and enhance their trading performance.

On Quotex, individuals can systematically develop trading strategies based on the McGinley Dynamic. Traders can avoid emotional decisions using this powerful tool, which provides objective entry and exit points.

Furthermore, a McGinley Dynamic trading strategy can improve overall trade performance by identifying market trends with greater accuracy, reducing market noise, and reducing the impact of market fluctuations.

CREATING ROBUST TRADING SYSTEMS WITH THE MCGINLEY DYNAMIC

Your trading journey begins with creating a robust trading system. Implementing such a system on Quotex is possible using the McGinley Dynamic.

Constructing Triggers for Trade Entries and Exits

First, the McGinley Dynamic lets you set clear triggers for entering and exiting trades. There is often a strong trigger point when the Dynamic line crosses the price line. An entry trigger for a long position could be a Dynamic line crossing the price from below and continuing to rise. On the other hand, if it crosses from above and keeps falling, it might trigger a short position.

It is possible to reverse exit triggers for exits. Exit your long position when the Dynamic line crosses the price from above if you are holding an extended position. A similar motivation could be the Dynamic line crossing below the price if you are in a short post.

Establishing Stop Losses, Take Profits, and Risk Management Rules

Second, McGinley Dynamic is suitable for establishing stop losses and taking profit levels. During a rising Dynamic line, consider placing your stop loss below the low point before the crossover occurs for a long position. Similarly, you could set your stop loss just above the high end before the crossover if you were shorting a place.

Set take-profit levels based on a predetermined risk-to-reward ratio. Taking a 10-pip risk on a trade with a 20-pip reward provides a 1:2 risk-reward balance.

Finally, the McGinley Dynamic assists in defining risk management policies. You can estimate the volatility of an asset by observing the distance between its Dynamic line and its price. This information lets you adjust your stop loss level and position size.

BOTTOM LINE

The McGinley Dynamic is one of the most indispensable tools for successful Quotex trading. You can make informed decisions based on real-time market insights, allowing you to maximize your return on investment. Thanks to its unparalleled responsiveness, Quotex’s dynamic indicator is a powerful tool for successful trading.