How to Trade the Morning Star on Quotex: A Simple Guide

Learn how to profitably trade the morning star pattern on Quotex with this step-by-step guide. Discover benefits, tips, and risk management strategies for successful trading.

Trading the morning star on Quotex is simple. In this article, we will take you through all you need to know to implement this powerful trading strategy on Quotex.

WHAT IS THE MORNING STAR?

A morning star is a bullish pattern with three candlesticks, observed by technical analysts. It emerges after a downtrend, signaling the beginning of an upward movement and a potential reversal in the previous price trend. Traders carefully observe the morning star’s formation and seek additional indicators to confirm the reversal.

Why Trade the Morning Star on Quotex

People normally trade the morning star pattern on Quotex because of the numerous benefits it offers. Here are some of these benefits.

- After a downtrend, the morning star pattern emerges as a powerful signal for a potential reversal in the trend. This pattern implies that the selling pressure is waning while buyers increase their influence, which could result in a potential price surge.

- The early ability to detect the morning star pattern allows traders to enter the market during the initial phases of a possible bullish trend. Getting in early can lead to improved risk-to-reward ratios and increased profit opportunities.

- The morning star pattern is a reliable indicator that offers well-defined risk management strategies. It presents clear entry points for traders, typically after forming the third candlestick. Stop-loss orders can be placed below the low of the last candlestick in the pattern to minimize risk.

TIPS BEFORE TRADING THE MORNING STAR ON QUOTEX

Let’s look at some tips for trading the morning star on Quotex.

Understand Basic Trading Concepts

First, keep the following conditions in mind when trading the morning star:

- The first candlestick should be a lengthy red candle, indicating a bearish trend.

- The second candlestick should be short and open lower than the first candle.

- The third candlestick should be a long green candle, opening higher than the second.

- To confirm the bullish reversal, you should complement the pattern with other technical indicators and fundamental analysis.

- If you are considering long positions, placing stop-loss orders below the low of the second candle is advisable. Profit targets depend on the asset’s price movements and your risk management strategy.

Research Market Trends and Price Movements

It’s a good idea to research market trends and price movements when trading the morning star pattern on Quotex. Here are some of the things you should focus on.

Before identifying the morning star pattern, ensure that the market is in a clear downtrend. Establish the context for a potential reversal by looking for a series of lower highs and lower lows on the price chart.

Once you spot the market downtrend, search for the distinctive morning star pattern on the price chart. Ensure that the three candles make up the pattern and that the second has the smallest price range.

During the morning star pattern formation, it is important to confirm the volume levels. A telltale sign of a potential bullish reversal is an increase in volume during the third green candle. This surge in buying interest strengthens the validity of the reversal signal.

Draw trendlines on the chart as they guide the overall direction and potential support points. The reversal signal gains more credibility, with the morning star pattern appearing near a support level.

Understand How Candlestick Patterns Work

The morning star is a visual pattern requiring no specific calculations. It consists of three candles, with the lowest point found on the second candle. However, this low point becomes evident only after the third candle closes.

In addition, you can use other technical indicators to anticipate the formation of a morning star, such as observing the price action approaching a support zone or checking the Relative Strength Indicator (RSI) for signs of oversold conditions in the stock or commodity.

Analyze Previous Candlesticks on the Quotex Platform

Analyzing previous candlesticks is crucial for gaining insights into the potential reversal when trading the morning star pattern. Consider these key aspects.

Before identifying a morning star pattern, ensure that there’s a distinct downward trend in the price movement. Watch for a string of successive bearish candlesticks demonstrating downward momentum.

The morning star pattern begins with a long red (bearish) candlestick, symbolizing the ongoing downtrend.

You can see the selling momentum through a short-bodied second candle that gaps down from the first candle, without much overlap with the first candle.

The third candle, a bullish long green candle, exhibits a strong shift in sentiment from bearish to bullish as it gaps up from the second candle and closes at least halfway into the body of the first red candle.

Familiarize Yourself with the Quotex Platform Features

A great part of traders’ success when trading the morning star on Quotex is their understanding of the platform’s features. When trading on Quotex, you have many different trade indicators and tools. Understanding these indicators and tools ensures that you can quickly analyze the markets and capitalize on possible entry points when trading the morning star pattern.

Prepare to Use Stop-Loss Strategy for Risk Management

It’s recommended to use stop-losses when trading the morning star pattern on Quotex. The primary advantage of a stop-loss order is its cost-effectiveness. Implementing a stop-loss order incurs no additional charges until the price triggers it and Quotex sells the security. Consider it a complementary insurance policy.

Furthermore, stop-loss orders offer the convenience of not having to monitor a security’s performance daily. This makes them particularly useful when you cannot actively watch your security for an extended duration.

STEP-BY-STEP GUIDE TO TRADING THE MORNING STAR ON QUOTEX

Now let’s go through a step-by-step guide to how to trade the morning star pattern on Quotex.

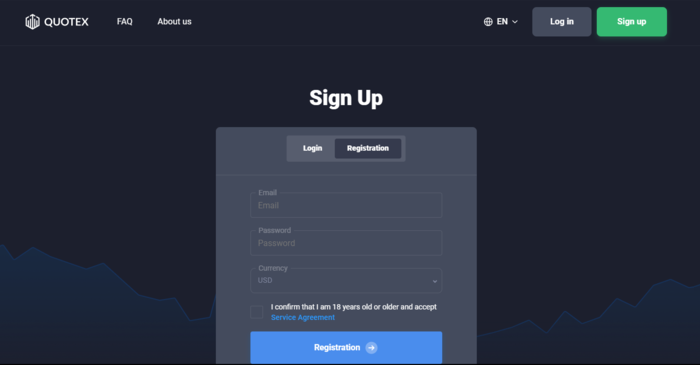

Register an Account with Quotex

Registering for a Quotex account is simple. You must first access the company’s web platform from your browser. You can do this by searching “Quotex” on your internet browser. You will see a register button on their platform, which will lead you to a registration form you must complete.

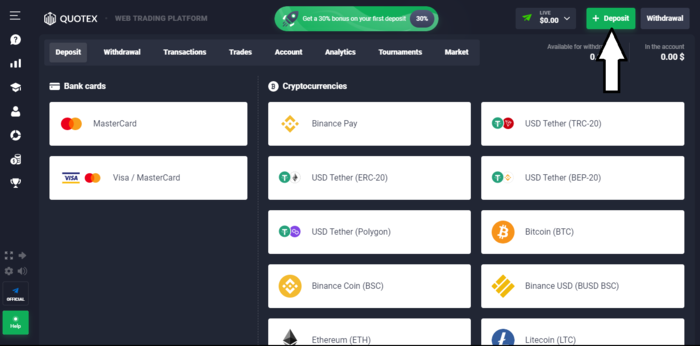

Fund Your Account with Funds Necessary for Trades

Quotex offers you numerous deposit methods to fund your account. You can access these options by clicking the deposit button on the top right of the trade execution window. There are no fees from Quotex to deposit money into the platform.

Open a New Chart in the Quotex Platform

To open a new chart on Quotex, click the ‘+’ in the top right corner of the trade execution window. This button will lead you to various options to choose from.

Identify a Bullish or Bearish Candle Pattern

Bearish candlestick patterns are red, while the bullish ones are green. Identification of these candlesticks is easy since you just use their colors.

Determine Whether a Morning Star Pattern Is Present

To determine if the morning star pattern is present, first identify a downtrend. Then watch out for the morning star pattern, which consists of a bearish candlestick, after which a smaller candlestick forms, then the third candlestick, which should be bullish.

BOTTOM LINE

You can profitably trade the morning star pattern today by following the instructions above. Carry out proper market research and identify the pattern before trading it. Trading the morning star pattern on Quotex can lead to improved risk-to-reward ratios and increased profit opportunities.