How to Maximize Flat Market Days at Quotex: A Trader’s Guide

Discover practical ways to spend your trading day at Quotex when the market is flat. Harness downtime, refine strategies, and stay prepared for future moves.

Markets are constantly changing. This change is most notable in terms of direction. You could have upward movements, downward movements, or sideways movements. Traders are most afraid of that last scenario, called a flat market.

In a flat market, it is not easy to open new trades. Even though one can take advantage of both upward and downward trends, a flat market offers few opportunities.

Market activity on platforms like Quotex remains active even when the market seems stagnant. The purpose of this guide is to explain flat markets, their advantages, and how they can help you make money on Quotex.

WHAT IS A FLAT MARKET?

The term “flat market” refers to a period when the price of a particular security does not rise or fall significantly. In flat markets, low trading volume or declining price movements in some securities offset increasing price movements in other securities and can lead to flat markets.

Benefits of Trading During Flat Markets at Quotex

There are several benefits to trading at Quotex during a flat market, including the following.

Time for analysis: Trading on flat markets allows traders to review and improve their past trades.

Less stress: Trading is less stressful when traders have less pressure to make immediate trades.

Ideal for range trading: By using advanced charting tools, it is possible to set up a range trading strategy. You can take advantage of a stock’s predictable oscillations by setting up “buy” orders near the support level and “sell” orders near the resistance level in a flat market.

Opportunity to learn: Flat markets provide the perfect opportunity for beginners to get acquainted with Quotex’s tools and features without the pressure of rapidly shifting prices.

Time to diversify: Quotex allows you to broaden your portfolio and hedge against future volatility in your primary asset by exploring other assets or trading instruments.

Wise traders recognize flat markets as opportunities, while others might overlook them. Quotex offers advanced trading tools and features to turn dormant periods into profitable ventures.

PREPARATION FOR A FLAT MARKET DAY AT QUOTEX

Navigating a flat market is like working with limited ingredients to create a gourmet dish — skills and preparation make all the difference. A seemingly monotonous flat market day can become a strategic trading opportunity with Quotex, a renowned trading platform. Below you’ll find tips on how you can prepare for and take advantage of flat market days.

Research the Current Market Situation

Understanding the prevailing market condition is pivotal. It’s about gauging the pulse of the market and identifying patterns. Quotex simplifies this with its “Market Analysis” feature, offering an in-depth view of various assets.

For example, let’s say you’ve earmarked the AUD/USD currency pair for trading. Upon logging in, you consult Quotex’s “Market Analysis,” which shows that the pair had had minimal price movement for several days, indicating a flat market scenario. In this case, the comprehensive insights Quotex provides you can help shape your daily trading strategy, perhaps by encouraging you to focus on leveraging minor fluctuations.

Analyze Price Movements and Technical Indicators

The beauty of Quotex lies in its intricate yet user-friendly charting tools. These tools allow traders to deeply probe price movements and evaluate various technical indicators, facilitating informed decision-making.

For example, consider using the Moving Average Convergence Divergence (MACD) to understand the momentum of the EUR/GBP currency pair. You may find that even though the market is flat, the MACD could still show minor crossovers within a narrow range. Thus, Quotex offers a lens to look beyond the apparent stillness of a flat market day, revealing opportunities within the calm. By capitalizing on these subtle MACD crossovers, you can execute several small but profitable trades.

Moreover, the candlestick patterns on Quotex can further enrich your analysis. The recurring “Doji” candles, symbolic of indecision in the market, can confirm the range-bound behavior of a currency pair. This deeper dive into technical indicators, facilitated by Quotex’s robust toolkit, can help traders reinforce their strategy of exploiting the minor price movements within the flat market.

Understand Your Risk Tolerance and Trading Strategy

Every trader, whether novice or seasoned, must be keenly aware of their risk appetite. This understanding forms the cornerstone of creating a successful trading strategy, especially on platforms like Quotex where so many options abound.

It’s highly recommended to explore features on Quotex like setting stop-losses and take-profits. Instead of diving headfirst into a potential trading opportunity, you can set a stop-loss slightly below your entry point, limiting your potential losses to a comfortable level. If that trade doesn’t go in your favor, thanks to the stop-loss, your losses would be minimal and well within your risk tolerance.

Choose an Appropriate Time Frame and Currency Pair to Trade

A single asset can tell different stories depending on the time frame you’re looking at. Platforms like Quotex allow traders to switch seamlessly between various time frames, providing insights that cater to different trading strategies.

For example, when looking at the GBP/AUD pair chart, you may focus primarily on daily charts. But one day, you might want to experiment by switching to a 4-hour chart. While the daily chart may portray a flat market on a certain day, the 4-hour chart can reveal intriguing minor trends ideal for short-term trading. Leveraging this new perspective, you could execute several trades that day, capitalizing on the minor price swings. Quotex, with its customizable view options, opens up a new world of opportunities for traders.

Gather News Announcements Related to Different Asset Classes

Despite being flat, markets are affected by major news announcements, even when they are not moving. With platforms like Quotex, you can stay informed about various asset classes in real time. A platform like Quotex helps traders stay informed and prepared even in a flat market.

EXECUTING TRADES DURING FLAT MARKETS AT QUOTEX

Aside from its innovative tools, Quotex allows traders to navigate sideways markets and still profit. Learn how to execute trades effectively on Quotex when the market is flat.

Use Direct Market Access to Trade Quickly and Efficiently

A direct market access system enables investors to interact directly with an electronic order book to execute trades. Buyers and sellers place their orders in an order book, which records them.

When a buyer wants to buy a security, the seller wants to sell it at a price that matches the buyer’s desire. Orders remain in the book until you complete them.

Leverage Low Trading Costs with Mobile Apps or Online Brokers

Low trading costs benefit flat markets, mainly where profit margins are thin due to confined price movements. A competitive trading cost ensures that traders maintain a more significant portion of their profits on Quotex, regardless of whether they use mobile apps or online platforms.

HOW EXPERIENCED TRADERS CAN BENEFIT FROM FLAT MARKETS AT QUOTEX

The lack of price movement in flat markets can deter some traders. Nevertheless, you can learn to appreciate these periods for the opportunities they offer.

Quotex’s robust tools and analytics can help you uncover market nuances during seemingly stagnant markets, allowing you to optimize your trading strategies.

Utilize Knowledge and Experience to Make Successful Trades in a Short Period

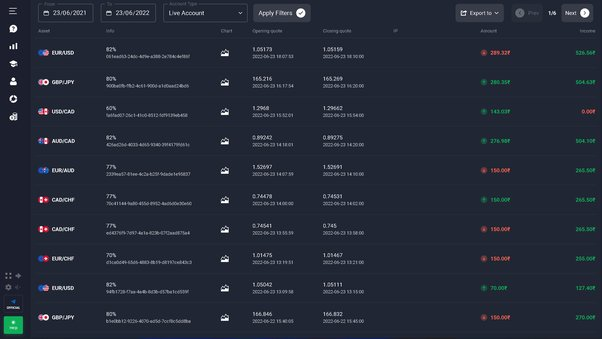

A flat market gives experienced traders a blank canvas to paint with their knowledge and strategy. Even during tight price ranges, you can find and act quickly on opportunities thanks to Quotex’s advanced features.

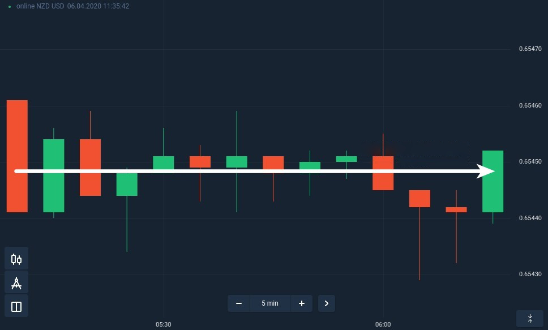

For example, let’s say you log in to your Quotex account to find a seemingly uneventful EUR/USD chart. Market behavior is classic flat, with the pair moving sideways.

However, when you switch to a 5-minute chart, you notice that it clearly shows minor resistance and support levels. Based on this, you can develop a strategy following the currency pair’s consistent oscillation between these points, profiting from the minor price changes.

Harnessing Quotex’s swift order execution, you can then initiate a series of trades throughout the day, capitalizing on the small movements between the support and resistance levels you previously pinpointed. Each trade yields modest gains, but collectively, by the end of the day, they amount to a commendable profit.

This is just one example of how, with the right platform and a seasoned approach, flat markets can transform from periods of inactivity into sessions of strategic trading. Quotex, with its advanced functionalities, has been an invaluable partner in helping countless traders navigate such days, turning challenges into opportunities.

TIPS ON HOW TO GENERATE CONSISTENT PROFITS WHILE TRADING DURING FLAT MARKETS AT QUOTEX

Despite their reputation for being uneventful, flat markets can offer traders numerous opportunities to generate consistent profits. The key lies in adapting one’s strategy to market conditions and leveraging the strengths of a platform like Quotex. Some proven tactics and examples during such periods are listed below.

Follow the Trend

Prices bounce between known support and resistance levels within a defined range in flat markets. However, exploiting subtle trends or patterns to gain profits within this range is often possible.

Let’s say that one day, while analyzing the GBP/JPY pair on Quotex, you notice that despite the overall sideways movement, a minor downtrend is forming, with each peak slightly lower than the previous one. You immediately recognize this as a “descending triangle” pattern within the broader flat market.

Using Quotex’s precise charting tools, you can draw trend lines to validate your observations. Once confirmed, you can position yourself to short the pair every time it approaches the descending trend line. This repetitive, trend-based strategy can help you profit consistently throughout the session.

Use Advanced Technical Indicators

Even in a flat market, technical indicators can provide insights into potential price movements.

For example, use the RSI (Relative Strength Index) on Quotex when observing different assets. The RSI could indicate potential overbought or oversold conditions in a flat market. When the RSI approaches the 70 (overbought) mark, the price soon retraces, and similarly, when it neared 30 (oversold), a reversal occurred. By acting on these RSI cues on Quotex, you can execute trades that capitalize on these minor retracements.

Harness the Power of Breakouts

Flat markets don’t remain flat forever. They eventually break out of their range, either upward or downward. Being prepared for these breakouts can lead to significant profits.

Let’s say that while observing the USD/CHF pair in a tight range on Quotex, you decide to set conditional orders (both buy and sell) just beyond the established resistance and support levels. The rationale is simple: You would capitalize on the subsequent momentum if a breakout occurred. Sure enough, a news announcement causes the pair to surge, triggering your buy order and resulting in a profitable trade.

BOTTOM LINE

Flat markets, often seen as trading’s quiet periods, are brimming with hidden opportunities for the observant and strategic trader. While they require a different approach than more volatile times, trading with platforms like Quotex equips traders with the tools and insights to navigate and profit from these waters. The key is adaptability, whether employing technical indicators, following subtle trends, or staying alert for potential breakouts. By staying informed, leveraging platform features, and maintaining a disciplined approach, consistent profits during flat markets aren’t just possible — they’re achievable.