Is the Martingale Strategy Suitable for Money Management in Quotex Trading?

Learn more about the Martingale strategy’s potential on Quotex. Optimize profit recovery by balancing risk management and investing wisely.

Have you ever wondered if the Martingale strategy could help you improve your trading performance on Quotex? How reliable is it when it comes to managing capital in binary options trading, particularly when trading on the Quotex platform? Let’s examine these questions and determine how to apply this strategy to Quotex trading.

WHAT IS THE MARTINGALE STRATEGY?

Gambling, especially betting games like roulette, is the source of the Martingale strategy, a popular money management strategy. The Martingale strategy requires you to double your bet after every loss so that you can recover your losses and earn a profit equal to your original stake if you win once.

As a way to manage investment sizes, the Martingale strategy can be used by Quotex traders. This strategy is based on the idea that a trader can recover from losses faster by increasing investment size. For Quotex traders, the Martingale strategy offers the following benefits:

- Quick recovery from losses: Traders may be able to recover their losses quickly after a loss by increasing their investment size.

- Easy to understand and implement: Trading with this strategy is simple and easy to implement.

However, it’s also important to remember that the Martingale Strategy can also come with risks. For example, you could lose significantly if you don’t execute a winning trade immediately. Therefore, you must be cautious when using it and consider your risk tolerance.

How Does the Martingale Strategy Work in Binary Options Trading?

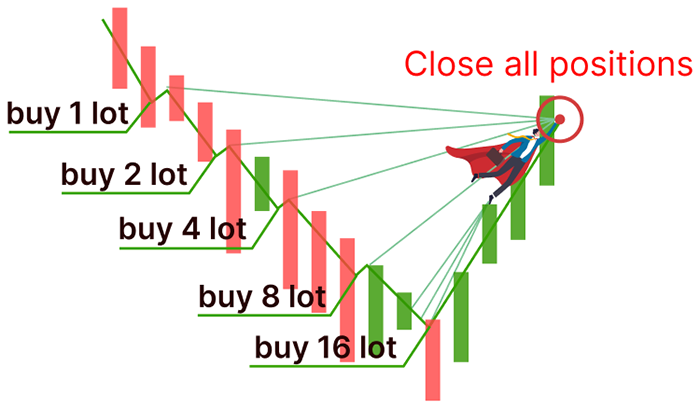

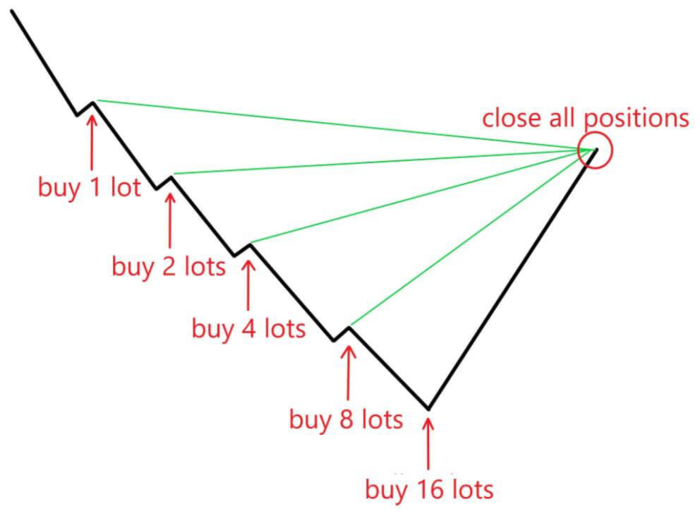

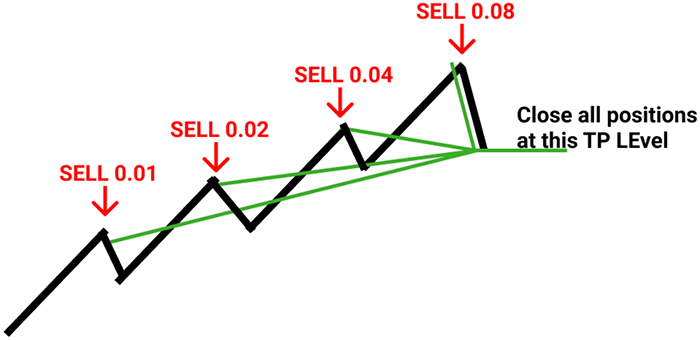

With binary trading, the Martingale strategy involves increasing your investment size after each losing trade until you win your trade. Based on this premise, a losing streak has a lower probability of occurring than a single winning trade.

Here’s an example of how Quotex might handle this.

Starting with $10, you predict that an asset’s price will surpass the current price after a certain period of time. In the event of a correct prediction, you earn money. In the event of an incorrect prediction, you lose your money.

The next time you trade, you double your investment to $20. Taking the second trade and doubling your investment to $40 for the next trade allows you to recover the $10 lost in the first trade. As you go through this process, you can eventually develop a winning trade.

Traders can, in theory, recover from losses using this strategy. However, this strategy can be risky, especially if they encounter long losses. The trading capital can be depleted, and the investment size can grow exponentially. Therefore, the Martingale strategy should be used cautiously, and traders who trade on platforms like Quotex must be aware of the risks involved.

QUOTEX TRADING PLATFORM OVERVIEW

A reliable and efficient trading platform is essential in the fast-paced world of online trading. Among the numerous available platforms, Quotex stands out as one that is gaining attention. But what exactly is Quotex? In what ways does the platform stand out from the rest, and how can people get started?

What Is Quotex?

With Quotex, users can trade various assets such as binary options, commodities, stocks, and indices in financial markets. Because of its user-friendly interface and wide range of features, it appeals to both novice and experienced traders. Providing an accessible and innovative trading experience is the goal of Quotex.

How to Open an Account on Quotex

You can open a Quotex account in a few easy steps. Here’s how.

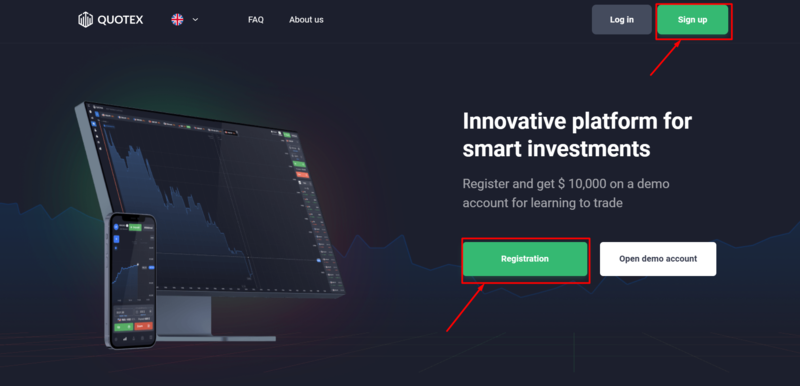

- Visit the Quotex Website

Go to the Quotex official website using your web browser.

- Click on the “Registration” or “Sign up” Button

Locate and click the “Registration” or “Sign up” button, usually found at the top-right corner of the home page.

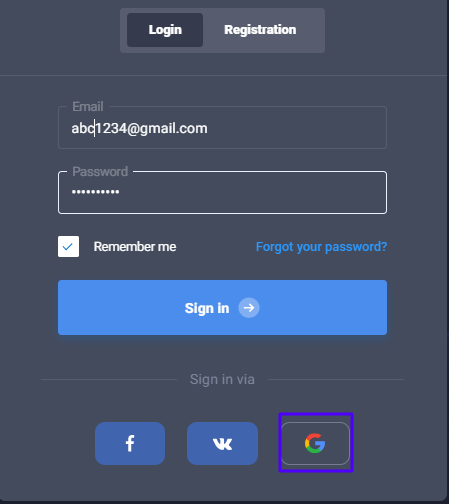

- Fill in the Registration Form

Enter your email address and create a password. You may also have the option to sign up using a social media account.

- Agree to the Terms and Conditions

Read and accept the terms and conditions and Quotex’s privacy policy.

- Verify Your Email Address

Check your email for a verification message from Quotex and click on the link provided to verify your email address.

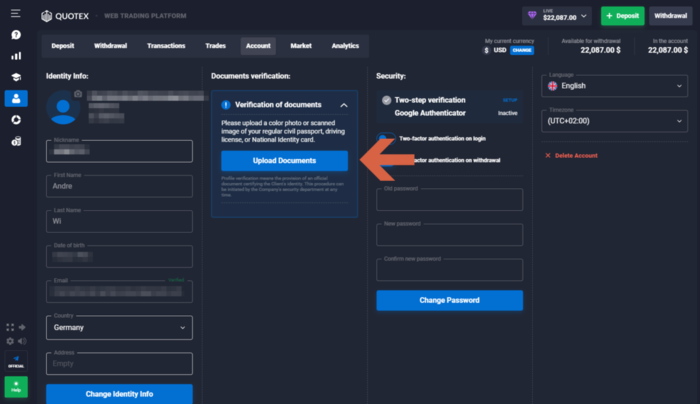

- Complete Your Profile

Once your email is verified, log in to your account and complete your profile by providing the necessary personal information.

- Deposit Funds

To begin trading, you’ll need to add funds to your account. Follow the instructions under the “Deposit” section.

- Start Trading

As soon as your account is funded, you can place trades and select assets of interest.

Features of the Trading Platform

The following features make trading with Quotex more enjoyable than other platforms.

- Wide range of assets: The Quotex platform includes many assets, such as currency pairs, commodities, stocks, and indices.

- User-friendly interface: Users of all levels can navigate and execute trades easily, thanks to the platform’s user-friendly interface.

- Technical analysis tools: Traders can conduct technical analysis using various charting tools provided by Quotex.

- Demo account: Quotex offers a demo account with virtual funds to help beginners get familiar with the platform.

- Mobile trading: Quotex provides traders with an app that allows them to manage their investments anywhere, anytime.

- Customer support: Customers can get support from Quotex via live chat and various other channels.

- Secure trading environment: Since users’ funds and data are protected, the platform employs security measures.

Quotex offers traders comprehensive and accessible trading platforms that are appealing to these traders.

HISTORY OF THE MARTINGALE STRATEGY

While its roots can be traced back to the gambling world, the Martingale strategy is a time-honored betting system. It is now used in various fields, including trading and investing. Understanding its origins and history can give insight into the nature and applications of the Martingale strategy.

Origins of the Martingale Strategy in 18th-Century France

In the 18th century, the Martingale strategy appeared to have originated from simple coin toss games in France. It was one of the most popular betting strategies in France, and it is believed that its name came from a French casino owner or perhaps a French term for a type of betting practice.

This strategy involves doubling your bet after every loss to recover previous losses and earn a profit equal to your original stake. Martingale is an approach to gambling that involves doubling your bet after every loss. The Martingale strategy was originally applied to a game where the gambler bets on whether a coin would land heads or tails.

As a result of the strategy, 18th-century French gamblers often gambled on binary outcomes, such as red or black in roulette. It was believed that the gambler would eventually win by doubling his bet after a loss, and when that happened, his losses would be recovered, plus he would earn a profit equal to his initial bet.

One of the major criticisms of the Martingale strategy is that it requires a substantial bankroll to maintain the exponential growth in bet size during a losing streak. The strategy is also fraught with dangers. Due to the high betting limits and the fact that gamblers often ran out of money in the 18th century, the strategy was not sustainable for long periods.

Although it has associated significant risks, the Martingale strategy has endured throughout history and has been adapted for uses other than gambling, such as trading and investment. Despite the fact that it also carries significant risks, its simplicity and the promise of quick profits have contributed to its long-lasting popularity.

PROS AND CONS OF USING THE MARTINGALE STRATEGY FOR MONEY MANAGEMENT ON QUOTEX

When managing money in Quotex trading, applying the Martingale Strategy has advantages and disadvantages. Traders would benefit by understanding these advantages and disadvantages before implementing the strategy.

Advantages of Using the Martingale Strategy with Quotex Trading Platforms

- Quick recovery from losses: To recover losses quickly with a single profitable trade, a trader can double their investment after a loss. An investor can, for example, invest $20 in the next trade if they lose $10 on their first trade, and if it is profitable, they recover the initial loss.

- Simplicity and ease of implementation: For new traders who may find complex strategies daunting, the Martingale strategy is simple and easy to incorporate into their trading routine.

- Potential for steady profits in the short term: Because the Martingale strategy capitalizes on winning streaks, it can provide steady profits over the short term.

Disadvantages of Using the Martingale Strategy with Quotex Trading Platforms

- Potential for large losses: Because this strategy increases investment size after every loss, traders can suffer significant losses when losing streaks are extended. For example, after 7 consecutive losses with a $10 trade, the last trade would require an investment of $1280.

- Capital depletion risk: When a trader experiences a series of losses, he or she may lose the ability to continue trading.

- Limitations due to account size: For traders with limited capital, increasing position size exponentially may not be feasible.

Perform Candlestick Pattern Analysis Before Making Decisions about Position Sizes

The Martingale strategy on Quotex should be applied after analyzing candlestick patterns, which can help identify market trends and determine position sizes more accurately.

The Martingale strategy may be used for subsequent trades if the market moves against the trader’s prediction — for example, if candlestick patterns indicate a possible bullish trend.

Be Aware That High Success Rates Can Not Always Be Guaranteed Even Following These Strategies

The markets can be unpredictable, so being prepared for the inherent risks involved in trading is essential, even with the Martingale strategy and candlestick pattern analysis.

Monitor Upward Trends and Adjust Position Sizes Accordingly to Maximize Profits

The Martingale strategy might indicate that a trader should increase position size more conservatively if they detect a strong upward trend to leverage the trend while minimizing risk at the same time.

Using the Martingale strategy in conjunction with other risk mitigation tools is essential, as it can be an attractive money management strategy for Quotex trading.

BOTTOM LINE

In Quotex trading, the Martingale strategy is one of the most appealing money management tools thanks to its simplicity and ability to recover from losses quickly. Traders should use this strategy cautiously and in conjunction with other analytical tools like candlestick pattern analysis. It carries significant risks, including the potential for large losses and capital depletion.

Ultimately, a trader’s risk tolerance, trading goals, and capital size determine whether the Martingale strategy suits them on Quotex. To effectively manage risks and to be aware of potential downsides, it is imperative to have a well-planned strategy.