How to Trade Candle Shadows with Fixed-Time Trades on Quotex

Discover candle shadow trading at Quotex. Learn how to use technical indicators to trade effectively, including various types of candle shadows.

Would you like to improve your trading strategies? Did you know candle shadows can significantly impact your trading decisions?

This guide explores the world of candle shadows within the context of Quotex, one of the most popular digital options platforms. This article aims to explain what candle shadows are, their benefits, and how to trade them at Quotex effectively with fixed-time trades.

WHAT ARE CANDLE SHADOWS?

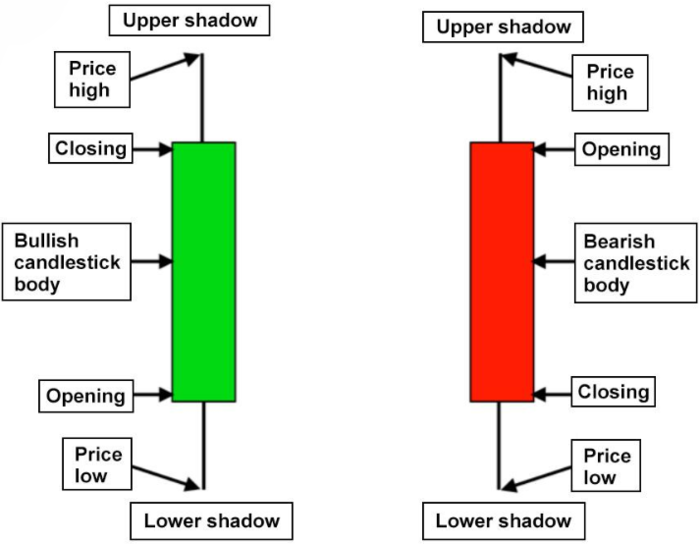

On a candlestick chart, candle shadows (also known as wicks or tails) show the price range beyond the opening and closing price. During the given period, they indicate the highest and lowest points. A higher shadow indicates a high price, while a lower shadow indicates a low price.

Candle shadows play a vital role in technical analysis on a platform like Quotex, which offers users an intuitive interface and advanced charting tools. Their analysis of market sentiment provides valuable insight. During a long upper shadow, for example, buyers drove up prices, but eventually, sellers forced them down. There is a potential for a bearish reversal here.

The Benefits of Trading Candle Shadows with Fixed-Time Trades on Quotex

There are several advantages to trading candle shadows at Quotex with a fixed-time trade.

Enhanced Market Understanding

The shadow of a candle shows the volatility of a market within a certain period. Their purpose is to help traders understand the tug-of-war between buyers and sellers. You can easily identify and analyze these shadows with Quotex’s advanced charting tools.

Improved Decision Making

Candle shadows allow traders to make informed decisions by predicting potential price reversals. Real-time data is available through Quotex’s platform, ensuring you have the most accurate information.

Risk Management

To manage their risk better, traders must understand the implications of different candle shadow lengths. The fixed-time trades at Quotex let you define your risk upfront, adding a layer of security to your trades.

User-Friendly Interface

A user-friendly platform is at the core of Quotex’s design. Thanks to the intuitive interface, traders of all levels will find viewing and analyzing candle shadows easy.

Accessible Education Resources

Quotex offers several guides and tutorials on candle shadows. For beginners and experienced traders alike, this makes it an ideal platform for strategy refinement.

TYPES OF CANDLE SHADOWS

A candlestick chart’s shadow, also called a wick or tail, plays a key role in interpretation. They can provide important insights into a particular period’s price action and market sentiment. We’ll explore how you can use candle shadows on Quotex and the different types of shadows there are.

Upper Shadows

In candlestick trading, upper shadows represent the high price point of the session, while lower shadows indicate how strong buyers were at the time.

Long-term traders in bullish markets look for candlesticks with a short upper shadow to indicate that buyers maintained control during the session, pushing prices close to the highs.

However, it tells a different story when the upper shadow is long. Even though buyers managed to push the price up during the session, they could not sustain it. Sellers then stepped in, forcing the price back to its opening, signaling a potential bearish reversal, especially if it had previously occurred in an uptrending market.

When you use the Quotex platform, upper shadows are easily visible on a candlestick chart. You can make better trading decisions by understanding the implications of different upper shadow lengths. If you see a long upper shadow forming, it might be a good idea to exit your long positions in a bullish market or even take a short position, anticipating a potential price drop.

Lower Shadows

A lower shadow is a thin line that extends from the bottom of the candlestick body to the lowest price point. In other words, they show the power of sellers during that session and the low point of the session.

Short lower shadows indicate that sellers controlled the market throughout the session, pushing the price very close to its lows in a bearish market. Long traders for that asset should take this as a negative sign.

Longer lower shadows, however, say something else. Even though sellers could push down the price during the session, they could not maintain the low price. The price rose as buyers stepped in, closing near the open. Observing this in a previously downtrending market could signal a potential bullish reversal.

A candlestick chart on the Quotex platform shows lower shadows easily. Different lower shadow lengths have different implications for trading, so understanding them will help you make better decisions. Exiting short positions in a bearish market might make sense if you see a long lower shadow forming, anticipating a potential price rise.

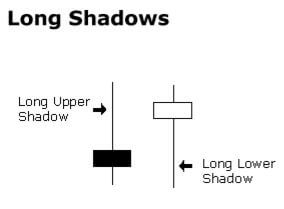

Long Upper and Lower Shadows

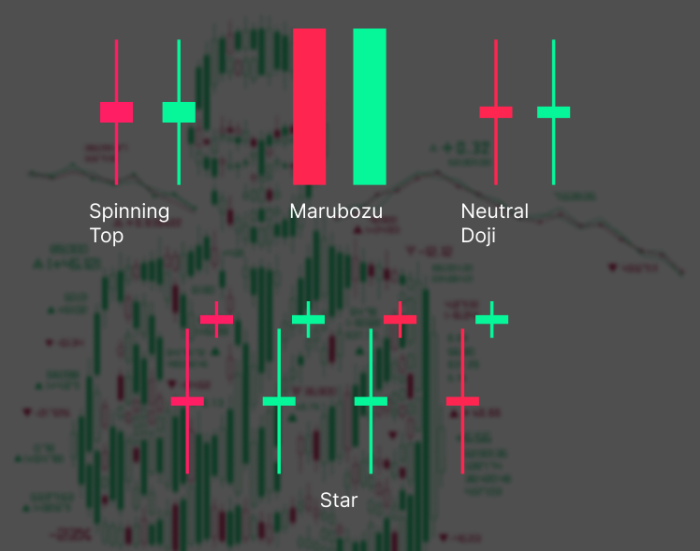

As the name suggests, spinning top candles have long upper and lower shadows. They have small bodies and long shadows that indicate a high level of market indecision. Despite dominance from buyers and sellers, neither could maintain control, hence a close near the opening.

Market direction changes often precede spinning tops. Spinning tops may indicate that a bearish reversal is imminent if they form during an uptrend. The opposite could also occur if a spinning top forms during a downtrend, suggesting sellers might lose control, which might signal a bullish reversal.

Spinning tops can be a warning to be cautious on the Quotex platform. Managing your risk might be easier if you tighten your stop losses or reduce your position size when you spot a spinning top. Before you make a trading decision, check for confirmation from other technical indicators and chart patterns.

Wide Range Candles

Long upper and lower shadows are characteristic of candles with wide ranges between their highs and lows. They indicate high volatility and high trading activity. When a candle is green (indicating buyers) or red (indicating sellers), it shows whether buyers or sellers dominated the session.

Green candles with wide ranges indicate strong buying pressure in bullish markets. The price rose mostly because buyers controlled most of the session. It could indicate that the uptrend is continuing, especially if the volume is also high.

Red candles with a wide range indicate strong selling pressure in a bearish market. Sellers drove the price down during most of the session. If the volume is also high, this could indicate that the downtrend will continue.

Depending on the price range of the candlestick, wide-range candles can indicate strong buying or selling pressure. This can result in a continuation or reversal of the current trend on the Quotex platform. Consider entering a long position when you spot a large green candle in a bullish market. If the market is bearish, consider entering a short position if you see a wide range of red candles.

Green and Red Candles

Candlestick charting relies heavily on green and red candles. A price chart visually represents a price’s movement over time.

A green candle indicates that the closing price was higher than the opening price, indicating that the buyers were in control. It is possible to gain additional insights based on the candle’s body length and shadows. For instance, green candles with short upper and long lower shadows signal strong buying pressure after the price has climbed from the low.

The color red (or black) indicates that sellers were dominant, as the closing price was less than the opening price. Additionally, candle shadows and body length can offer insights. For instance, red candles with short lower and long upper shadows indicate strong selling pressure from sellers by pushing the price down from the high.

Candles with green and red shadows on the Quotex platform can be valuable market sentiment indicators. Making better trading decisions is possible through understanding how candle colors and shadow lengths impact your trading. Considering a long position might be prudent if you see multiple green candles with short upper and long lower shadows, anticipating an upward price trend.

Bullish Engulfing Patterns

Bullish engulfing patterns in candlestick charts are major reversal signals for the bulls. Small red candles are followed by larger green ones that engulf the red ones. Buyers now hold more power than sellers, based on this pattern.

Red candles in this pattern indicate that sellers were in control, indicating a decline from opening prices. Having opened lower than the first candle’s low and closed higher than its high, the second candle is a long green candle. Buyers stepped in with force, reversing the day’s losses and increasing prices.

A bullish engulfing pattern is a strong buy signal, especially after a significant downtrend or at a support level. There is a likelihood of a bullish reversal since buyers have overcome sellers’ pressure.

Quotex platform users can consider entering long positions if they spot a bullish engulfing pattern. Nevertheless, it’s also important to consider other factors, such as volume, other technical indicators, and overall market conditions, when analyzing a trading signal. A strong bullish reversal is more likely after a bullish engulfing pattern with high volume.

TECHNICAL ANALYSIS OF CANDLE SHADOW TRADING STRATEGIES

Analyzing technical indicators such as volume and price movement is part of technical analysis, a trading discipline. It uses various charting tools, indicators, and patterns to predict the price movement of future securities. Candlestick charts and candle shadow analysis within them are key elements of technical analysis.

A candle’s shadow, or wick, can provide valuable insight into price action during a particular period. Depending on their length, you can determine the strength of buying or selling pressure and the highs and lows they have reached. Trading strategies can be developed using candle shadows and other technical analysis tools in conjunction with candle shadows.

Various technical analysis tools are available to traders on the Quotex platform for analyzing candle shadows. Examples of technical indicators would be trend lines, resistance, support levels, and moving averages.

In addition to helping traders identify potential entry and exit points, manage their risk, and make more informed decisions, candle shadow analysis may also aid traders in making more profitable decisions.

Candle shadow trading strategies often involve looking for long shadows that cross or touch trend lines, resistances, or supports. The longer the upper shadow, the more likely it is that the price will reverse to the downside if it breaks through resistance levels. Long lower shadows can also touch support levels, signaling that a bearish reversal is likely when the level has held.

An alternative strategy involves identifying long shadows on overbought or oversold stocks. An asset in overbought conditions might show a long upper shadow, signaling a potential candle structure trading bearish shadow reversal. However, an asset in oversold conditions could receive a bullish reversal signal if a long lower shadow forms.

Using Technical Indicators to Identify Potential Reversals in Price Movement

In technical analysis, the price and volume of an asset help to calculate mathematical formulas. Traders can use them to predict future price movements based on their unique perspective on market data. It is possible to identify potential reversals in price movement when combined with candle shadow analysis.

Several technical indicators are accessible on the Quotex platform, such as moving averages, relative strength indices (RSIs), moving average convergence divergence (MACDs), and Bollinger Bands. There are a variety of ways in which each of these indicators can give different insights into market conditions. They can also complement candle shadow analysis in several different ways.

Regarding momentum oscillators, the RSI measures how fast and how often prices change. When the indicator oscillates between zero and one hundred, it indicates an overbought or oversold condition. An RSI above 70 indicates an overbought asset, and an RSI below 30 indicates an oversold asset.

With candle shadow trading, long upper shadows could indicate a potential bearish reversal if the RSI exceeds 70. The asset may be due for a price correction because the long upper shadow suggests buyers cannot sustain the high prices.

RSIs below 30 indicate a potential bullish reversal when a long lower shadow forms. In this case, the long lower shadow suggests that sellers could not keep the price low, and the oversold conditions suggest that a bounce in price may be looming.

Trading on the Quotex platform is made more informed by combining candle shadow analysis with technical indicators, which can help traders identify potential reversal points more accurately.

BOTTOM LINE

A candlestick chart’s shadow provides valuable insights into market sentiment and price movement. It is important to understand the different types of candle shadows — such as upper shadows, lower shadows, long upper and lower shadows, wide range candles, green and red candles, and bullish engulfing patterns — to help you improve your trading strategies.

Combining this knowledge with technical indicators on the Quotex platform can greatly increase your success in trading.