Is Overtrading a Big Challenge in Quotex Trading?

Learn why overtrading is a common pitfall for digital options traders — and how to avoid it with Quotex, a platform that offers high returns and low risks.

If you’re a novice trader, you may have goals of making huge profits with just a few positions. A lot of people share your dream.

However, do not fall prey to overtrading just because you want to get rich quickly with your trading in Quotex.

In this article, find out what overtrading is, why it happens, and how to avoid it with some simple but smart strategies.

WHAT IS OVERTRADING, AND WHAT CAUSES IT?

Overtrading is the act of trading too often or too aggressively in the financial market. While it can lead to large profits, it can also incur significant psychological risks and ruin your digital options trading success.

Traders can become overwhelmed by the sheer number of trades they make, leading to burnout, fatigue, and stress. These heightened emotions can lead to impulsive and irrational decisions, resulting in large losses.

There is no hard definition of overtrading. You can’t put a number to it, like saying that 10 trades a day is overtrading or that placing even 100 trades a day is overtrading.

Overtrading comes down to the behavior, not the number. If you don’t trade with a strategy and you keep impulsively opening and closing positions, then that would be considered overtrading.

If you’re a scalper working in lower timeframes, like a 1-minute option expiry, you may find 20 good trading opportunities in a day with your well-built trading system. You would have certain entry rules and a history of good win rates. Such a scenario does not count as overtrading.

Conversely, if you are addicted to trading and open positions out of compulsion, that would be a case of overtrading.

The major cause of overtrading is a dream to become rich overnight. Traders think they will make more money if they trade more. But in fact, the opposite is true — the more you trade, the more you are exposed to risk.

Secondly, if you run behind in quantity, you lose the quality of your trades. A few precise entries are much better than a host of mindless trades that might lead you to lose your entire capital.

WHAT ARE THE SIGNS OF OVERTRADING?

You might wonder how to assess whether you are overtrading. Here are a few common signs of overtrading.

Desperation

One of the biggest signs of overtrading is a feeling of desperation. Sometimes there’s no trading opportunity, but you still desperately want to trade anyway.

You might be considering switching to different trading instruments and time frames or trying another strategy. Patience is the key to avoiding such a situation.

Feeling Regret

You are likely a victim of overtrading if you open a position and then close in a loss with deep regret. Regret stems from undisciplined actions.

Following your trading strategy may keep your perspective in focus so that you don’t regret your trading decisions, even if you face losses in certain transactions.

Neglecting Your Strategy

Straying away from your chosen strategy is yet another key reason for overtrading. A trading strategy comprises rules for entry and exit. It has a certain winning rate and risk-to-reward ratio as well. It gives you the confidence to trade.

However, if you ignore your strategy and trade just for the sake of trading, then you will just be gambling all your money away. There’s no way you’ll come out on top.

More Positions than Usual

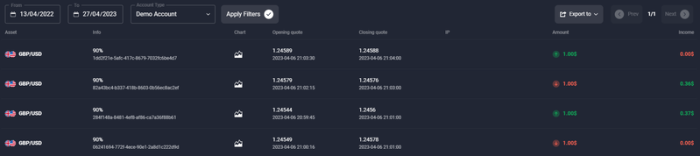

If you look at your trading history, you can find your average daily and weekly trades. Are you seeing a sharp uptick in your number of trades?

Placing more trades than usual can be a sign that you’re slipping into overtrading territory. For example, let’s say your average number of daily trades is 10, and currently you have 15 trades per day without any significant reason. This is a sign of overtrading that may lead to a significant loss.

KNOW THE RISK OF OVERTRADING IN QUOTEX

Most traders ignore that they must take risks to make a profit. Every position involves a certain amount of risk. While trading with Quotex, your average payout possibility is 80%.

That means if you risk $100, you can earn $80 — in other words, the risk is greater than the reward. Therefore, you must maintain a 60% win rate above the breakeven. In such a case, overtrading may disturb your win rate, leading to low profitability or net losses.

You may at some point face a series of lost trades. In some cases, traders lose 5 to 10 trades in a row. Two losses eat up around three profit transactions, so if you trade randomly or go beyond the limits, you can turn your profit into a loss.

MONEY MANAGEMENT IN QUOTEX

While trading in the Quotex trading platform, you must be cautious about your money management to play the long game.

The broker provides an accurate calculation of your risk and the payout. Use that to calculate your overall risk with the help of your winning rate and payout average.

Let’s clarify this further with the help of an example.

Suppose you invest $100 in your Quotex trading account. It would be best not to stake over $1 per trade (1% of your total equity).

Let’s assume the payout is 80% ($0.80 against the risk of $1). You only blow your account if you lose 100 trades in a row.

If you had 100 trades with a win rate of 60%, your lost sum would be $1 x 40 = $40, while your profit would be $0.80 x 60 = $48. So, the net profit would be $8 or 8%.

You can apply the same principle and make a reasonable profit with a substantial deposit. It’s more about mindset than the investment. That’s what differentiates professionals from traders who end up losing.

PSYCHOLOGICAL RISK OF OVERTRADING

Don’t let overtrading affect your mental health and trading success. Learn how to create a trading plan and manage your money wisely with Quotex.

The psychological risks of overtrading are real and can be very damaging. Often traders become overly confident and take on more risk than they can handle.

This can lead to large losses, which can cause traders to become despondent and depressed. It can lead to negative thought patterns and a lack of confidence, ultimately leading to further losses.

The best way to avoid the psychological risks of overtrading is to ensure that you have a well-thought-out trading plan that you follow diligently.

It’s important to have reasonable expectations and to focus on risk management. Take regular breaks and take time away from the markets to ensure you don’t get burned out.

Also, it’s important to stay disciplined and stick to your trading plan.

The psychological risks of overtrading can be severe and negatively impact your trading performance. Be aware of these risks and take steps to ensure that you are trading responsibly and with the proper risk management strategies.

TIPS TO AVOID OVERTRADING IN QUOTEX

Now that you better understand overtrading, let’s explore some key tips to avoid it.

Below are seven practical tips to avoid overtrading and improve your digital options trading performance with Quotex. Learn how to plan, limit, and track your trades.

- Make a Trade Plan

Remember, having no plan is the worst plan. You should understand the importance of a trade plan before you get started. Create a plan around your “risk of ruin.” You must see how many consecutive losses can blow your trading account and the probability of facing such a situation.

It helps to allocate risk for each position. Your trade plan should include a well-tested strategy with at least three months of forward testing data, having a win rate higher than 60%.

- Don’t Trade All Day

The more you trade, the more you’re exposed to losing money. Always trade like a sniper shot instead of rapid fire. It’s better to have 5 well-planned trades than 50 random trades.

It’s always better to fix your timing for trade. For example, the London session’s opening time has higher volatility, opening up many opportunities. You can schedule your trading around such times.

- Limit the Number of Daily Trades

If you place a limit around your daily number of trades, it helps you stick to your plan. You should not stray from this limit, as it helps avoid unwanted losses. The daily limit depends on your trading style, strategy, and previous trading history.

- Take a Pause When You Lose

You may lose several trades in a row. This should not impact your emotions. You should not engage in revenge trading. Close your trading screen, take a break, refresh yourself, and start again without recency bias hanging over your head.

- Broaden Your Focus

Working on higher time frames is advantageous for traders. Even if you’re a scalper, keeping your bias aligned with higher time frames and fundamental factors makes you less likely to fall prey to financial market whips.

- Maintain a Trading Journal

We highly recommend maintaining a trading journal to avoid overtrading. Record each trade with the date, entry, exit, and reason for the trade in your journal. This is the best remedy to save you from the psychological challenges of trading and to improve your trading skills.

- Goals and Motivation

Finally, keep your goals fair and attainable. Overambitious goals may trigger overtrading. Keeping goals is important to keep you motivated.

QUOTEX TRADING STRATEGY

Want to trade digital options with Quotex like a pro? Learn this simple strategy using moving averages and timeframes to boost your profits.

While trading on the Quotex trading platform, you should keep your strategy simple and easy. Here’s one strategy that may help. We advise you to test it in your demo account before executing it on your live account.

Choose the moving average period of 20 from the list of technical indicators.

Switch to the 4-hour timeframe.

Look at the chart below. It shows that the 20-moving average is below the price, which is bullish. Hence, you should look for long entries in the 1-minute time frame. Choose the 5-minute expiry.

Now look at the 20-moving average in 1 minute. It is also below the price, confirming the bullish signal. That means you can bet on the up.

BOTTOM LINE

Overtrading poses a big challenge while trading in Quotex, as in any trading platform. Following the tips discussed above will help you keep your strategy in focus so you’re not trading from your emotions.