Don’t Blow Your Quotex Account: Avoid These Common Trading Mistakes

Learn why most traders fail to make money in Quotex trading and how to avoid blowing your account. Find out the common mistakes and best practices to succeed in online trading.

Are you a trader who has blown several trading accounts? The distress of failure and losses can ruin your physical and mental health, especially because most people go into trading to make a sustained living.

On top of that, it can be very painful if a trader loses their entire capital. Let’s talk about some common reasons traders can’t make money and how you can preserve your Quotex trading account.

WHAT ARE QUOTEX ACCOUNTS?

Quotex is a user-friendly platform that lets you trade various options with a low minimum deposit and flexible expiration time. It’s a new way of investing online that offers great returns.

The Quotex platform allows you to trade various financial instruments, such as currencies, commodities, stocks, and indices, using advanced tools and strategies.

You can create a Quotex account for free and get access to a demo account with $10,000 to practice your skills.

You can deposit as little as $5 and start trading with real money. Quotex accounts allow you to use different indicators, signals, and charts to analyze the market and make accurate predictions.

You can also customize your trading interface and choose the expiration time that suits your style. Quotex accounts are designed for beginning and experienced traders who want to make smart investments online.

WHAT ARE THE MOST COMMON TRADING MISTAKES?

To succeed in Quotex trading, avoid common trading mistakes that would affect your results. Here are some of the most common mistakes and how to avoid them.

Trading Without a Plan

Quotex allows you to trade various financial instruments, such as currencies, commodities, stocks, and indices, using advanced tools and strategies.

However, you should not trade without a plan. A trading plan is a set of rules and guidelines that define your trading goals, risk management, entry and exit points, and strategies.

Trading without a plan can lead to emotional and impulsive decisions, resulting in losses. To avoid this mistake, you should always have a clear and realistic trading plan and stick to it.

Trading Against the Trend

Also, you should not trade against the trend. The trend is the general direction of the market movement over time.

Trading against the trend means going against the prevailing market sentiment and trying to predict reversals. This can be very risky and difficult, especially for beginners.

You should always follow the trend and trade toward the market momentum to avoid this mistake.

Trading with Too Much Leverage

Quotex allows you to use leverage to increase your trading position and potential returns. However, you should not trade with too much leverage.

Leverage is using borrowed funds to increase your trading position and potential returns. However, leverage also increases your risk and exposure to market fluctuations.

Trading with too much leverage can result in losing more than your initial investment and getting a margin call. To avoid this mistake, you should always use leverage wisely and according to your risk tolerance and experience level.

Trading with Too Much Emotion

Quotex has a user-friendly and comfortable interface that does not distract you from the main thing — trading. However, you should not trade with too much emotion. Emotion is one of the biggest enemies of traders.

Emotion can cloud your judgment and make you act irrationally. For example, fear can make you close your trades too early or too late, while greed can make you overtrade or chase losses.

To avoid this mistake, you should always trade with logic and discipline and keep your emotions in check.

Trading Without Learning

Quotex gives you access to a demo account with $10,000 to practice your skills and training materials to learn more about trading.

As you trade, remember to always keep learning. Trading is a continuous learning process that requires constant improvement and adaptation.

Trading without learning means repeating the same mistakes and missing out on new opportunities. To avoid this mistake, you should always be learning from your own experience and from other traders, books, courses, webinars, and so on.

MARKET ANALYSIS

Market analysis can help you to make better trading decisions and increase your chances of success. Quotex has various tools and features to help you effectively perform market analysis and trade.

Why Do You Need to Analyze the Market?

You need to analyze the market in Quotex because it can help you to:

- Understand the current and future trends of the financial markets and the factors that influence them.

- Identify the best trading opportunities and the optimal entry and exit points for your trades.

- Develop and improve your trading skills, strategies, and techniques.

- Manage your risk and money effectively and avoid unnecessary losses.

- Increase your confidence and consistency in trading and achieve your trading goals.

How to Effectively Analyze the Markets on Quotex

There are two common ways to analyze the markets. They are:

- Fundamental analysis

- Technical analysis

For fundamental analysis, you should stay updated with trending news and key market events like interest rate decisions, unemployment rate, GDP growth, etc.

Either you analyze them well and trade with the bias, or you can avoid trading during high-impact events.

For technical analysis, you should be well versed with price action techniques, candlestick patterns, and technical indicators like moving averages, RSI, Stochastic, etc.

Luckily, technical indicators and key news events are readily available on the Quotex trading platform.

UNDERSTANDING RISK AND REWARD RATIOS IN QUOTEX

Learn how to use risk and reward ratios in Quotex trading to improve your performance and results. Find out how to set risk limits for your account and evaluate potential rewards for each trade.

Risk and reward ratios measure how much you can potentially lose or gain from a trade. They can help you evaluate the trading profits and feasibility of your trades and manage your risk and money effectively.

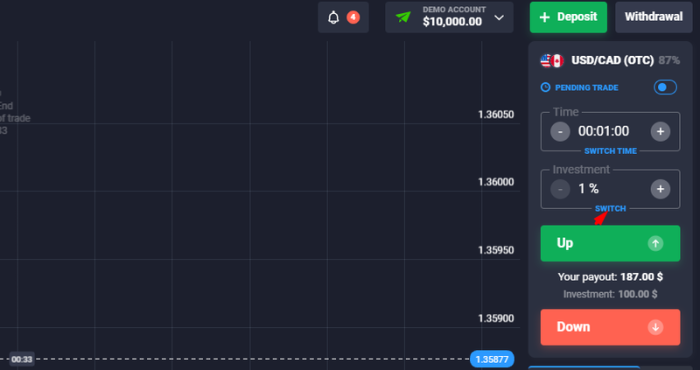

Quotex allows you to adjust your trades’ risk and reward ratios by choosing the expiration time and the payout percentage.

Setting Risk Limits for Your Account

Risk limits are the maximum amount of money you are willing to lose or risk from your Quotex account. Setting risk limits for your account can help you protect your capital and avoid losing more than you can afford.

Quotex allows you to set risk limits for your account by choosing the stake amount. It should not be more than 1% so that you can avoid blowing your account even if you lose several trades in a row.

Knowing When to Take Risks

Taking risks is inevitable in Quotex trading, as it involves uncertainty and volatility. However, taking risks does not mean gambling or being reckless.

Knowing when to take risks means knowing the Quotex market conditions and their opportunities and challenges.

Quotex helps you know when to take risks by providing various tools and features to analyze the Quotex market and make informed decisions.

Some of the tools and features that Quotex offers include indicators, signals, charts, and news. You can use these tools and features to know when to take risks and when to be cautious.

Evaluating Potential Rewards for Each Trade

Potential rewards are the possible outcomes or returns that you can expect from a Quotex trade.

Evaluating potential rewards for each trade can help you assess the profitability and feasibility of your Quotex trades and manage your expectations and emotions.

Quotex allows you to evaluate potential rewards for each trade by showing you the payout percentage and the profit amount before you enter a trade. The payout percentage is the amount of money you can earn or lose from your trade, varying from 60% to 98%.

The profit amount is the difference between your investment and payout amounts. You can use this information to evaluate potential rewards for each trade and choose the best option.

MAKING USE OF TOOLS AND STRATEGIES IN QUOTEX

Quotex is a unique trading platform with several features.

However, to succeed in Quotex trading, you must use tools and strategies that can help you analyze the market, make accurate predictions, and manage your risk and money effectively.

Quotex provides various tools and features to enhance your trading experience and performance. It also allows you to use strategies that suit your trading style and goals.

We will discuss further what tools are available for traders in Quotex and what strategies you should use to maximize profits in Quotex.

What Tools Are Available for Traders in Quotex?

Let’s check out some of the great tools that Quotex offers: charts, indicators, signals, and news.

Charts

Charts are graphical representations of the current price movements and patterns of financial instruments over time.

Charts can help you visualize the market behavior and identify trends, support and resistance levels, breakouts, reversals, etc.

Quotex offers you different types of charts that you can use to analyze the market and find trading opportunities. Some charts available in Quotex are line charts, candlestick charts, bar charts, and area charts.

You can also change each chart’s time frame and zoom level according to your preferences and trading style.

Indicators

Indicators are mathematical calculations applied to financial instruments’ price and volume data. Indicators can help you identify the market’s future price direction, strength, momentum, and volatility.

Quotex offers several indicators that can help you analyze the market and find trading opportunities. Some of the indicators are moving averages, Bollinger bands, MACD, RSI, and Stochastic.

You can customize the settings and parameters of each indicator according to your preferences and trading style.

Signals

Signals are alerts or recommendations generated by algorithms or experts based on market conditions and analysis. Signals can help you to enter or exit trades at the right time and in the right direction.

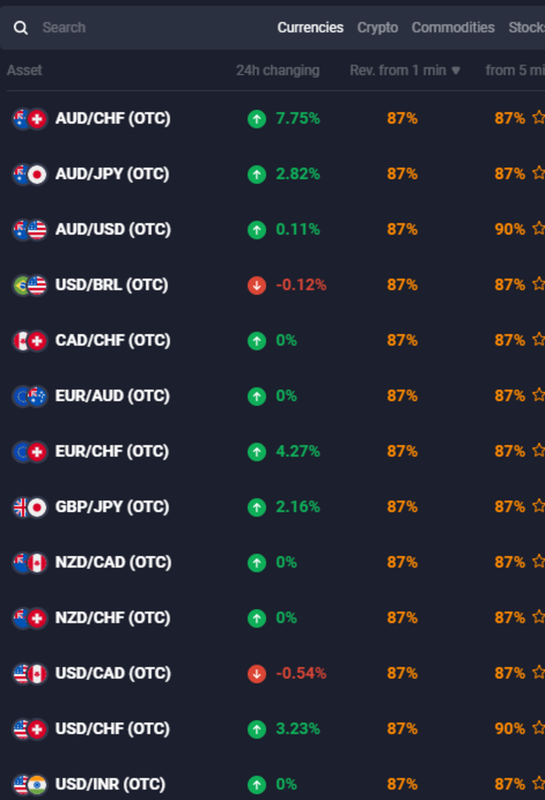

Quotex provides you with integrated signals that have an accuracy of 87%. You can use these signals to create an effective trading strategy and boost your income. You can adjust the signal frequency and sensitivity according to your needs and risk appetite.

News

News refers to events or announcements that can significantly impact the financial markets. News can cause sudden changes in the price and volatility of financial instruments. Quotex keeps you updated with the latest news and events affecting financial markets.

You can use this news to anticipate market reactions and take advantage of market movements. You can also filter the news by categories, such as economic, political, social, etc., according to your interests and trading goals.

What Strategies Should You Use to Maximize Profits in Quotex?

Quotex allows you to use strategies that suit your trading style and goals. Here are some strategies you can use to maximize profits in Quotex.

Trend Following

Trend following is a strategy that involves following the market movement’s direction over time. Trend following can help you predict future price movements and avoid trading against the market sentiment.

To use this strategy, you should identify the trend using indicators, such as moving averages or trend lines, and trade in the direction of the trend.

Breakout

Breakout is a strategy that involves trading when the price breaks out of a consolidation or a range. Breakout can help you catch strong asset price movements after periods of low volatility or indecision.

To use this strategy, you should identify the consolidation or range using indicators, such as Bollinger bands or horizontal lines, and trade when the price breaks out of it with high volume.

However, the most popular is the rectangular price pattern, where the price remains consolidating within a tight range and then breaks out.

Reversal

Reversal is a strategy that involves trading digital options when the price changes its direction from an uptrend to a downtrend or vice versa. Reversal can help you to profit from market corrections or changes in market sentiment.

To use this strategy, you should identify the reversal using indicators, such as MACD or RSI, or patterns such as double tops or bottoms, head and shoulders, etc., and trade when the price confirms the reversal with a candlestick pattern or a signal.

WHY TRADING PSYCHOLOGY MATTERS

Many traders have a winning strategy and enough capital to trade, but they can’t yet make enough to depend on profits from trading.

The psychological barrier is quite a big one in trading. You can blow your account if you feel emotional pressure or have too much greed to make a big sum overnight.

This all leads to impulsive trading, which is a big cause of failure in trading. Hence, you should practice your strategy on the demo for a long enough time to avoid fear and other heightened emotions on the live account.

And finally, you should never stray away from your trading plan.

TAKING TOO MUCH ADVICE FROM OTHERS

Taking too much advice from others is a common mistake many Quotex traders make. It can negatively affect your trading performance and results.

Here are some reasons why taking too much advice from others is bad:

- It can confuse you and make you doubt your analysis and decisions.

- It can distract you from your trading plan and goals.

- It can make you dependent on others, making you lose your identity as a trader.

- It can expose you to biased or inaccurate information or opinions.

To avoid taking too much advice from others, you should:

- Trust yourself and your abilities and skills as a trader.

- Follow your trading plan and rules that suit your trading style and goals.

- Do your own research and analysis using the tools and features that Quotex provides.

- Seek advice from reliable and reputable sources only when necessary.

CUTTING LOSSES QUICKLY IN QUOTEX TRADING

Cutting losses quickly in Quotex trading is a good practice that can help you to protect your capital and avoid losing more than you can afford.

Cutting losses means closing your trades when they reach a certain level of loss that you have predetermined or when the market conditions change in your favor.

To cut losses quickly in Quotex trading, you should:

- Close the position before expiration. This can save you from losing the entire staked amount.

- Follow the trend and trade in the direction of the market momentum.

- Be flexible and adaptable to changing market conditions.

BOTTOM LINE

There are several critical reasons why you could fall into deep losses. Hence, you should build your technical knowledge, create a trading plan, and be well aware of your psychological barriers in trading. Losses are inevitable in trading, but limiting the losses will help make you a professional trader.