Compound to Conquer: Earn More with Compounding on Quotex

Take your financial growth to the next level with Quotex. Unlock the world of compounding, manage your risks, and watch your capital flourish.

If you’re looking to maximize your profits on Quotex, consider compounding. Do you need help understanding how compounding works? Is it possible to make a substantial profit using this strategy?

When used correctly on Quotex, compounding can be a game-changer for traders. Let’s go over how you can make money with compounding.

WHAT IS COMPOUNDING ON QUOTEX

A financial principle known as compounding — the “eighth wonder of the world” — involves reinvesting profits to earn additional profits from an investment. Essentially, compounding involves earning interest on interest. Using the power of compounding in trading on Quotex, you can reinvest your profits into new trades, increasing your profits exponentially over time as your capital grows with each reinvestment.

This process is made easy thanks to Quotex’s intuitive and user-friendly platform, which makes it easy for traders to reinvest their profits consistently. When traders make consistent profits and reinvest them systematically, they can enjoy compound growth.

What Is Quotex?

Traders have access to all the tools and resources they need to trade a wide range of financial instruments, such as binary options and forex, through Quotex, one of the top online trading platforms.

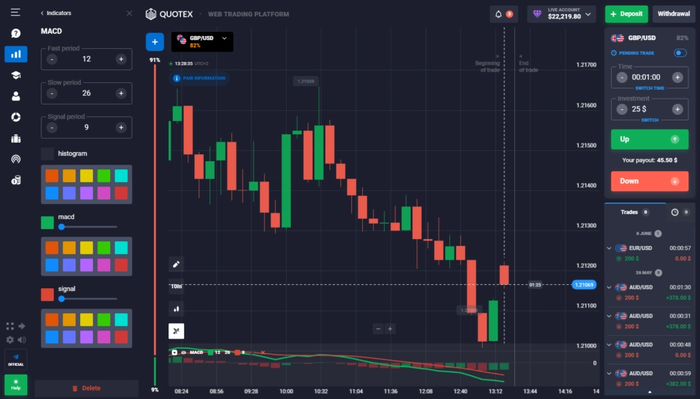

User-friendly interface: The Quotex interface is easy to use, enabling users to reinvest their profits, which is essential for compounding in forex trading.

Diverse assets: Because Quotex offers a variety of assets, traders can diversify their investments, increasing the stability of returns.

Advanced trading tools: Quotex provides advanced charting tools and indicators, which can help traders make better decisions and compound profits over time.

Flexible investment options: Traders can make investments and reinvest them easily with the platform, allowing them to compound their profits.

Educational resources: Quotex offers educational resources to help traders better understand compounding and how to utilize it effectively.

Traders can exponentially grow their investments over time by understanding compounding and leveraging Quotex’s features.

BENEFITS OF COMPOUNDING ON QUOTEX

Quotex offers a variety of benefits when you take advantage of compounding. As well as increasing your earnings potential, it offers a variety of advantages, such as making the most of your time, managing your risks more effectively, and acquiring good assets. Here are a few benefits to consider.

Saving Time and Money

You can save time and money by compounding on Quotex. An investor who makes a 10% profit on a $100 investment could reinvest the $10 profit into the next trade. As a consequence, you will be able to increase your trading capital without having to add more money to your account.

Compounding also reduces trading costs since you will need fewer trades to meet your financial goals. Other aspects of your trading strategy can be improved by focusing on other important aspects or pursuing other interests.

Risk Management

Investing less in your trades when you compound your earnings can also help you manage risk. Let’s say you make $1000 and risk 5% of it every time you trade. By compounding your capital, the 5% will grow over time, allowing you to earn more with a smaller investment. This strategy reduces large losses.

Increased Earning Potential

A notable benefit of compounding is that it increases earnings potential. If you reinvest your profits at a 10% rate on Quotex, a $1000 investment can grow to $3,138 after a year. If you take out only $1,200 from your monthly profits, you will earn significantly more.

Access to Quality Assets

Investing in Quotex enables you to access higher-quality assets that may be beyond your reach with a small initial investment, such as stocks and commodities. With compounding, your capital increases, and you can diversify into these quality assets, potentially resulting in greater returns and a more stable future.

Multiple Asset Classes

When you compound with Quotex, you can diversify across several asset classes. Because your capital base increases, you can trade cryptocurrencies, stocks, forex, and more. You could start with forex trading and expand into cryptocurrencies and stocks as your capital grows, spreading risk and opening up lucrative opportunities.

Tax Benefits

The tax advantages of compounding depend on the jurisdiction where you reside. Capital gains taxes are generally only applied when you withdraw profits, so you can defer taxes by reinvesting your earnings through compounding. As a result, more capital remains in your account, earning returns. To understand the specific tax implications in your country, it’s always a good idea to consult with a tax professional.

Compounding offers traders a powerful and efficient way to grow their capital over time. By fully understanding and utilizing this concept, traders may attain their financial goals more rapidly.

HOW TO GET STARTED WITH COMPOUNDING ON QUOTEX

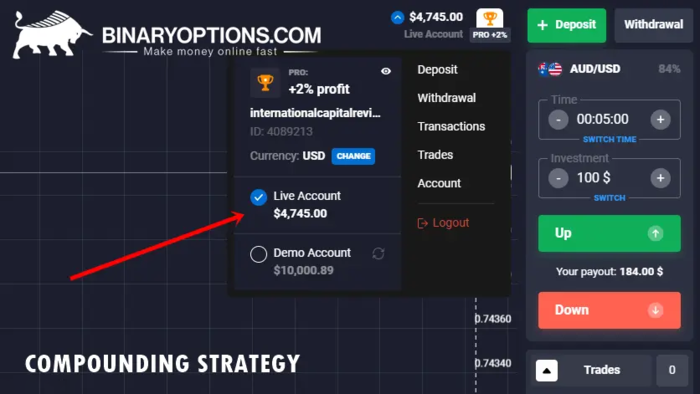

On Quotex, compounding can take place step-by-step by creating an account, establishing trading strategies, and effectively managing profits and positions. Let’s dive into each of these steps to help you launch your compounding journey on Quotex successfully.

Creating an Account

You’ll need to create a Quotex account before you can compound. Here is a guide on how to do this.

- Visit the Quotex website: Click the “Sign up” or “Register” button.

- Enter your details: Enter your email address and a password to create your account. The strength of your password determines the security of your account.

- Verify your account: Your account may be verified via a link in your email.

- Complete KYC procedures: Identification documents may be required as part of a Know Your Customer (KYC) process based on your jurisdiction.

- Make your first deposit: When your account becomes active, you should make your first deposit. Compound interest can grow even a small deposit over time. Avoid depositing a large amount at once.

- Familiarize yourself with the platform: Get to know the Quotex platform by exploring it. Learn how to use the different tools and assets available.

SETTING UP YOUR TRADING STRATEGIES

Creating an account is the first step. The next is to establish compounding strategies, which you can do by following these steps:

- Set clear goals: Identify the goals you want to accomplish through compounding. Setting realistic profit targets and understanding your risk tolerance is crucial.

- Choose assets wisely: Consider your trading strategy before selecting assets. Spread risk across multiple asset classes.

- Leverage trading tools: Consider the market trends and make informed trades using Quotex’s advanced trading tools.

- Decide on investment amounts: Determine the percentage of your capital you will invest and how much profit you will reinvest in each trade.

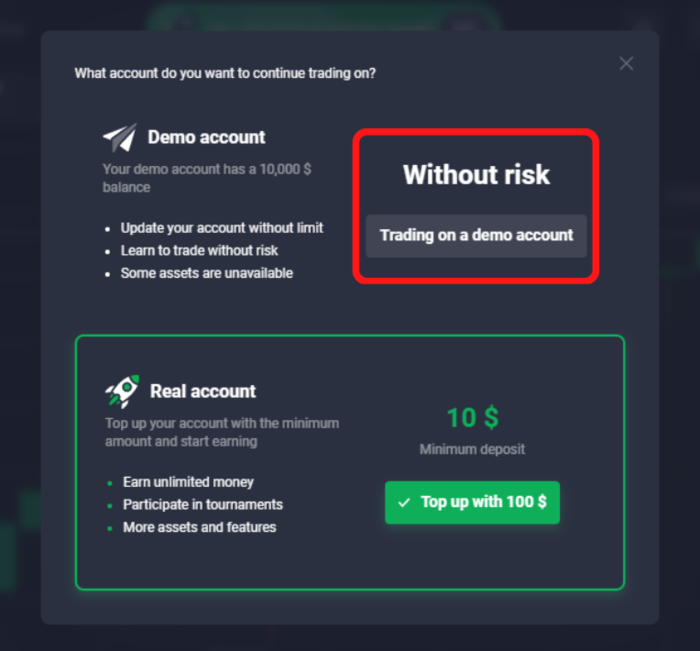

- Test your strategy: Make sure your strategy works by using a demo account before going live. Based on performance, adjust as needed.

Managing Your Positions and Profits

For successful compounding, you must effectively manage your profits and positions:

- Monitor your trades: Monitor your open positions and market movements. To manage risks, use take-profit and stop-loss orders.

- Reinvest profits: Reinvest profits into new trades as they come in. Compounding is the essence of the process.

- Regularly review your strategy: Market conditions change, and your strategy should as well. Make sure your trading strategy aligns with current market conditions by regularly reviewing and adjusting it.

- Keep records: Keep track of all your trades, including profits, losses, and strategy changes. You can analyze your performance and make informed decisions based on this information.

- Stay informed: Keep up with the latest market trends and news. Making timely and informed decisions will be much easier if you have this information.

- Don’t be greedy: You must be patient and disciplined when compounding. Traders should avoid making decisions based on emotions.

The process of compounding on Quotex involves careful planning and disciplined execution. With the power of compounding, you can grow your capital over time by creating an account, implementing well-thought-out trading strategies, and effectively managing positions and profits.

Compounding is more about consistent growth than quick profits, so staying patient and disciplined is crucial. Making informed decisions and diligently managing your portfolio will help you achieve your long-term financial goals by compounding on Quotex.

TYPES OF COMPOUNDING STRATEGIES ON QUOTEX

Understanding the different strategies available when compounding on Quotex can’t be overstated. One of these strategies is margin trading. Let’s explore margin trading and how to use it for compounding in Forex trading.

Margin Trading

Trading on margins allows traders to invest with borrowed capital, increasing the size of their trades and, consequently, their potential profits. It acts as collateral for the borrowed funds in this scenario. Margin trading can amplify gains but also increase losses, so it’s important to keep that in mind.

Using margin trading as a compounding strategy is as easy as following these steps:

- Starting capital and margin: If you have a $1,000 account with Quotex and decide to leverage your trading capital, the platform may offer you the leverage of 10:1, allowing you to trade with $10,000 instead of your $1,000.

- Opening a position: Now that you have increased capital, you can open larger positions. For example, you may want to purchase a cryptocurrency that will grow in value.

- Compounding gains: You can reinvest your profits as you make them. For example, if you made $200 in profits, you could reinvest these profits and re-use the margin. With leverage of 10:1, you would now have $1200 capital and could trade with $12,000.

- Reinvesting and growing: Compounding with leverage will result in the exponential growth of your capital as you reinvest profits.

- Managing risks: Managing your risk effectively is essential when using margin as a compounding strategy. Use stop-loss orders and review your positions regularly.

As an example, let’s look at what happens when you use a compounding formula in trading.

If you believe that a cryptocurrency will increase in value over the next week, you invest $1000 and leverage it 10:1. You open a $10,000 position. You close your position with a profit of $1000 as the cryptocurrency increases by 10%.

Assuming you have $2000 in capital, you can open a position worth $20,000 with your leverage of 10:1. Rather than withdrawing your profits, you reinvest them. Investing your profits and making successful trades will grow your capital.

The potential rewards of margin trading are high, but the risks are also high, so caution is advised. Don’t use too much of your capital for margin trading, and make sure you have a risk management strategy in place.

BOTTOM LINE

Compounding on Quotex presents an opportunity for traders to maximize their earning potential over time. It’s possible to grow your capital exponentially over time with compounding, regardless of whether you are a beginner or an experienced trader.

Still, it’s important to develop a well-thought-out strategy for each trade and understand the risks invoiced. When done right, compounding can be a very profitable strategy for traders.