4 Secret Tricks from an Experienced Trader at Quotex

Is your trading world overwhelming you with too much information? Are you wondering how to maximize profits and minimize losses on the Quotex platform? In this article, learn the secrets of top traders to help you optimize your experience on Quotex.

Let’s look at four strategies that experienced traders use to navigate the complex yet exciting world of Quotex trading. Aside from technical analysis, these tricks cover topics such as market conditions, money management, emotional control, and how to master your trading platform.

WHAT IS QUOTEX?

In various financial markets, traders can profit from price fluctuations using Quotex’s digital options trading platform. Since its inception, Quotex has rapidly gained popularity among traders worldwide with its mission of providing a user-friendly, reliable, and technologically advanced trading environment.

Traders can trade various financial instruments on Quotex’s cutting-edge trading platform, including currency pairs, commodities, indices, and stocks.

The trading platform combines intuitive design with advanced features at the heart of Quotex. Traders profit by predicting whether these assets’ prices will go up or down within a specified time frame.

About the Experienced Trader

With Quotex, experienced traders will have access to various features and tools. Quotex provides an ideal environment for advanced market analysis and efficient execution of trades due to its user-friendly interface and state-of-the-art trading tools.

Experienced traders can diversify their portfolios with the platform’s impressive selection of assets for binary options trading. The trading platform also offers various charting tools, including technical indicators, which are crucial to conducting comprehensive technical analyses.

Traders can employ short-term and long-term trading strategies with Quotex because it supports a variety of time frames. In addition to offering a detailed history of past trades, the platform can be incredibly helpful in developing and refining trading strategies.

SECRET TRICK 1: TECHNICAL ANALYSIS

The first secret weapon in trading is technical analysis. Technical analysis, or technical analysis of indicators, is a method investors use to track market trends and identify potential trading opportunities.

What Does Technical Analysis Mean?

By analyzing price patterns and market trends in the financial markets, technical analysis can predict future price movements. It is based on the idea that market prices tend to move repetitively. Technical analysis involves using charts and technical indicators to identify trends, support levels, and other price patterns.

How to Use Technical Analysis in Binary Options Trading

An individual trading binary options must predict whether an asset’s price will be higher or lower than a certain level at a specific point in the future, and technical analysis can aid in this process.

Using technical analysis in binary options trading can be as simple as doing the following:

- Using moving averages and identifying the trend lines

- Finding support and resistance levels

- Using technical indicators that can forecast price changes and generate buy and sell signals

Different Types of Technical Indicators and Their Uses

Traders can use several different types of technical indicators. A few examples are explained below.

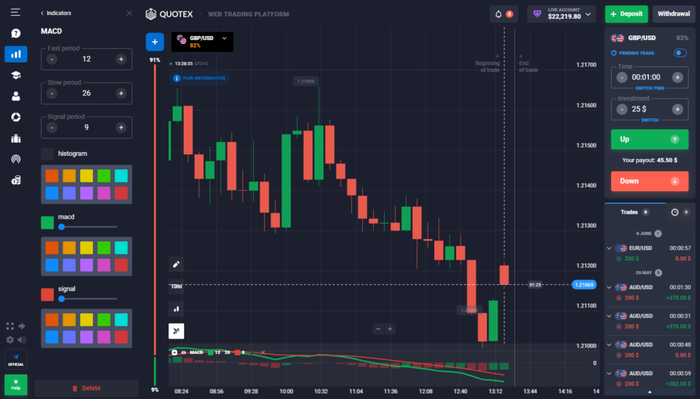

Trend indicators (trend-following): Trend indicators are used to determine a trend’s direction. MACDs are moving average convergence divergences and moving averages (MAs).

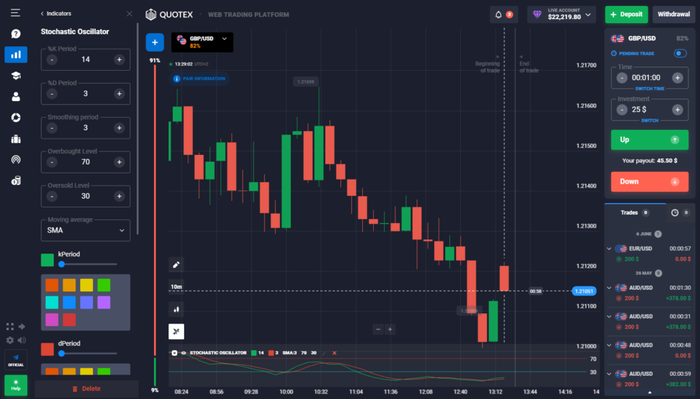

Momentum indicators: Relative Strength Indexes (RSI) and stochastic oscillators determine overbought or oversold conditions.

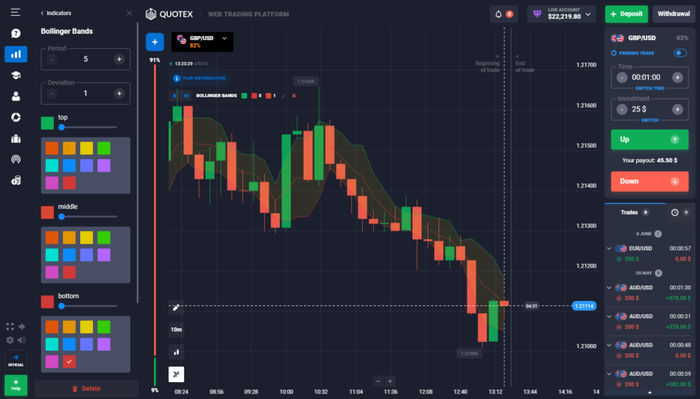

Volatility indicators: Indicators such as Bollinger Bands and Average True Range (ATR) measure the rate of price fluctuations, no matter their direction.

Volume indicators: On-Balance Volume (OBV) and Chaikin Money Flow (CMF) are two indicators that can confirm or signal a trend change.

Examples of Profitable Trades Using Technical Analysis

As you watch the hourly chart for GBP/USD, you see a 10-period SMA that calculates the average closing price of the last 10 hours. This indicator adjusts with each passing hour. Let’s say that at 1:00 the GBP/USD price is $1.38, higher than the 10-period SMA. This could indicate that the price is on the rise.

Imagine that you enter a long position by buying $25 worth of GBP/USD at $1.38. Your position on GBP/USD has increased to $1.39 at 3:00. As you bought at $1.38 and sold at $1.39, this trade has made you a profit.

Depending on whether you used leverage (if any), how many units you bought with $25, and whether you incurred transaction costs or fees, you will make a profit or a loss.

SECRET TRICK 2: MARKET CONDITIONS

To be successful in trading, you need to understand the current market conditions. Traders who have experience know that different strategies work best in different market environments, and they adjust their approach accordingly.

Monitoring Current Market News and Price Activity

Traders should pay attention to price movements and factors causing major price movements on the Quotex platform if they’re interested in trading a particular asset. Trading opportunities can be identified by tracking and analyzing price activity, spotting trends, and identifying potential opportunities using the platform’s tools and features.

Understanding Price Action and Future Price Movements

Another important aspect of trading is understanding price action. Price action can be interpreted using technical analysis by experienced traders who can identify patterns that help predict future price movements.

Traders can understand price movement by viewing charts and technical indicators on Quotex. By observing past price movements, traders can predict the future movements of an asset. It is important to take other factors into account when evaluating trading patterns, as they do not guarantee future results.

Spotting Market Opportunities Through a Trading Strategy

By using trading strategies, traders can identify trading opportunities as well. These strategies often use technical indicators to determine entry and exit points.

Suppose a trader’s trading strategy involves a crossover of short-term and long-term moving averages.

In that case, they may purchase an asset when the short-term moving average crosses the long-term moving average. Conversely, the trader might purchase the asset when the long-term moving average exceeds the short-term moving average.

Experienced traders will choose a strategy based on the current market conditions and their knowledge of them. With these strategies, traders can identify trades more effectively using the platform’s technical analysis tools.

SECRET TRICK 3: TRADING PLATFORMS AND SIGNALS

To maximize profits, experienced traders must rely on trading platforms and signals. Their method is as follows.

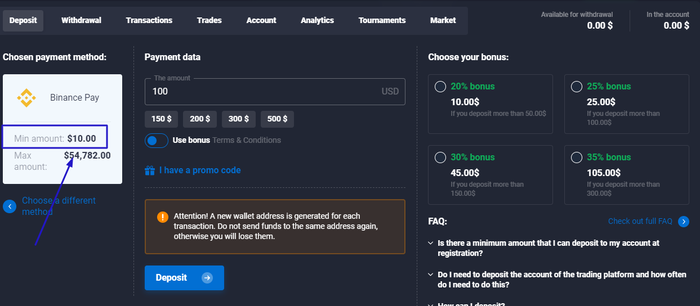

Reliable Binary Options Brokers with Low Deposits

A broker like Quotex allows you to start trading with little money. Ensure the broker you choose offers a safe, secure, and transparent trading environment as well as a low deposit amount.

Traders of all levels can count on Quotex’s transparent operations, security for their funds, and user-friendly interface, as it caters to novice and experienced investors alike.

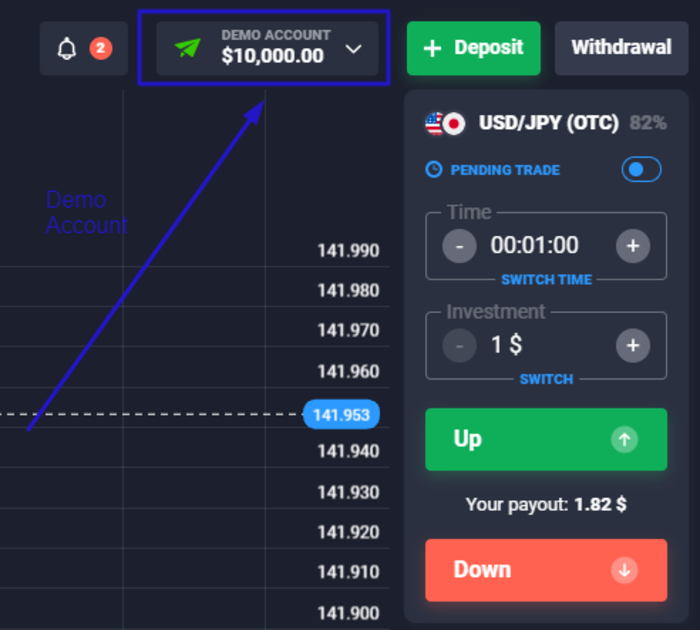

Taking Advantage of a Demo Account to Test Your Strategies

Use a demo account to test your trading strategies before investing real money. Demo accounts allow you to trade using virtual funds, so you don’t risk real capital. This is a great way to gain insight into how the platform works and to improve your strategies.

Test your strategies with virtual funds when you use the Quotex demo account to practice trading, familiarize yourself with the platform’s features, and become familiar with the trading platform.

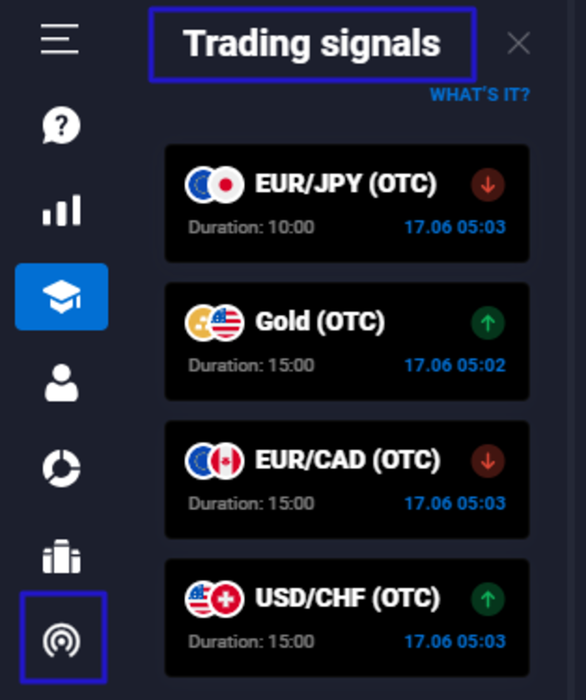

Finding Optimal Signals by Exploring Many Trade Platforms

Depending on your trading style, your trading platform will offer different trading signals that you should review to determine which are most advantageous to you. By following these signals, you can be alerted to potential trading opportunities based on trends and patterns in the market.

You can use Quotex’s technical analysis tools and indicators to find these signals. Managing your risks effectively and never investing more than you can afford to lose is crucial. Don’t forget to balance your risk tolerance and potential reward.

SECRET TRICK 4: MONEY MANAGEMENT AND EMOTIONAL CONTROL

Risk management and emotional control are key concepts experienced traders emphasize but novices often overlook. A good strategy isn’t enough if you risk too much per trade or let your emotions dictate your actions.

Setting Strict Stop-Loss and Take-Profit Points

Before entering a trade, traders should determine their risk tolerance. Stop-loss and take-profit points should be clearly defined for every trade.

Stop-loss orders limit potential loss by automatically closing your position when the price reaches a specific level. On the other hand, take-profit orders lock in profits once a specific price level has been reached.

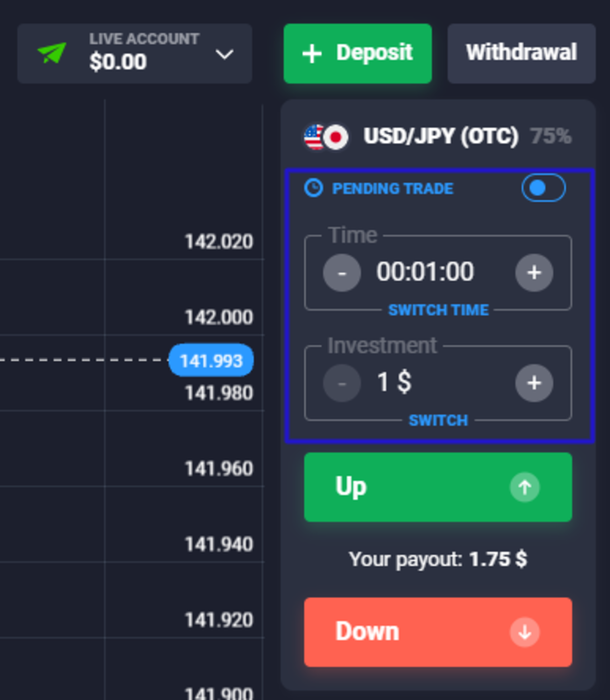

You can still set stop-loss and take-profit orders when trading binary options on Quotex, even though it doesn’t have stop-loss and take-profit orders in the traditional sense.

Never Risk More than a Fixed Percentage of Your Trading Capital

Experienced traders generally follow a rule to limit the amount of their trading capital they risk on each trade to a fixed percentage between 1% to 3%, which may vary depending on their risk tolerance.

With this rule, a trader can continue trading and potentially recover from losses despite unsuccessful trades that do not significantly impact their capital. To ensure that your binary option investment size aligns with your risk management strategy, you can easily adjust it on Quotex.

Keeping Emotions in Check

Keeping emotions in check can help you make better trading decisions. Fear and greed cause traders to over-risk their money or hold on to a lost position for too long.

A successful trader understands that not every trade will be profitable and that losses are integral to the trading process. They understand that emotions must be separated from trading decisions. Traders can improve their chances of success in the long run if they maintain a clear head and stick to their trading plan.

BOTTOM LINE

There is a fine line between an art and a science when it comes to trading. Several important aspects of this art have been discussed here, including technical analysis, understanding market conditions, using trading platforms and signals effectively, and managing money and emotions.

These are the areas you need to master to gain an edge in your trading journey. In trading, as in any activity, there are risks involved, so take precautions and only trade with money you can afford to lose. The Quotex platform can be improved by following these tips and using patience.